Climate change – an underlying challenge

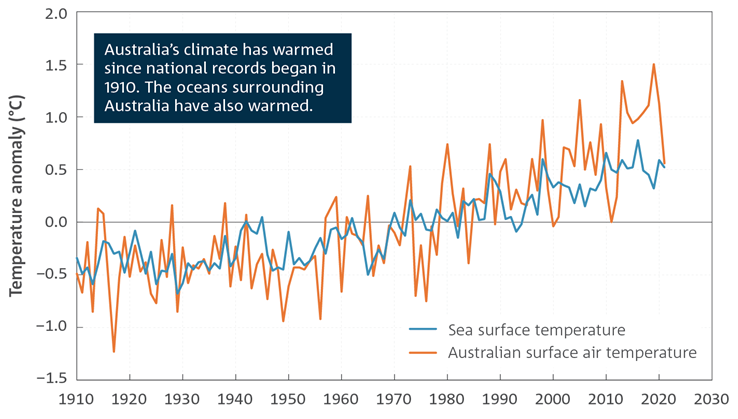

As we discussed in our paper ESG INSIGHTS: INSURANCE CLAIMS HEAT UP, the climate in Australia has warmed meaningfully by 1.0 – 1.5 degrees Celsius since around 1960 (refer Figure 1), with heightened greenhouse gases as a by-product of burning fossil fuels trapping greater heat within the atmosphere.

Figure 1: Rising annual mean temperature in Australia (1910 – 2030)

Source: Bureau of Meteorology

Weather cycles (El Niño/La Niña and Indian Ocean Dipole) – Another consideration

While global warming has resulted in climate change, and is an increasing challenge for insurers, insurers can ultimately price for this underlying trend via higher insurance premiums over time.

Within this underlying trend of global warming, there are also overlaying weather cycles. Some of the key cycles that meteorologists watch out for include El Niño Southern Oscillation (ENSO), Indian Ocean Dipole (IOD), and to a lesser extent Southern Annular Mode (SAM).

Arguably, the main weather cycle to watch out for is El Niño Southern Oscillation (ENSO). ENSO events are caused by the interaction between the surface layers of the ocean and the overlying atmosphere in the tropical Pacific. The El Niño phase of ENSO are often accompanied by cooler than normal sea surface temperatures along the east coast of Australia.

Over much of Australia, but particularly eastern Australia, El Niño events are associated with an increased probability of drier conditions, i.e. less rainfall. During the La Niña phase of ENSO, the opposite occurs and is often associated with an increased probability of wetter conditions.

An area of focus in Australia recently has been the weather conditions over the last three years. 2020-2022 saw the Bureau of Meteorology (BoM) declare an ENSO alert for a La Niña three years in a row. This rare event saw extended periods of rainfall and flood risks skyrocket, with some notable catastrophic events such as the 2022 SEQ/NSW floods and Halloween Hailstorm of 2020.

The last three years had also seen a negative IOD which, in conjunction with La Niña, had significantly contributed to the prolonged and widespread wet weather.

What is the IOD and how does it Interact with ENSO?

The Indian Ocean Dipole (IOD) is defined by the difference in sea surface temperature between the western Indian Ocean and the Eastern Indian Ocean. The IOD affects the climate of countries that surround the Indian Ocean, including Australia. Like ENSO, the IOD is impacted by sea surface temperatures and the overlying atmosphere, but in the equatorial Indian Ocean. A positive IOD is associated with drier conditions over Southern Australia and the Top End. A negative IOD is associated with wetter conditions in those same regions.

It is thought that the IOD and ENSO are somehow linked, and that positive IOD are often associated with El Niño. Similarly, a negative IOD is often associated with La Niña, like we have experienced here in Australia over the last three years. When this occurs, the La Niña and El Niño events are often more intense and widespread across the country. When they are out of phase, the impacts of La Niña and El Niño events can be more moderate.

What is the outlook for ENSO and IOD for 2023?

BoM’s ENSO outlook has recently shifted from “Watch” to “Alert” for an El Niño. This means that there is roughly a 70% chance of an El Niño forming in 2023.

While the IOD is currently neutral, various weather models are suggesting that a positive IOD could develop in winter. This may exacerbate the drier conditions that El Niño typically brings.

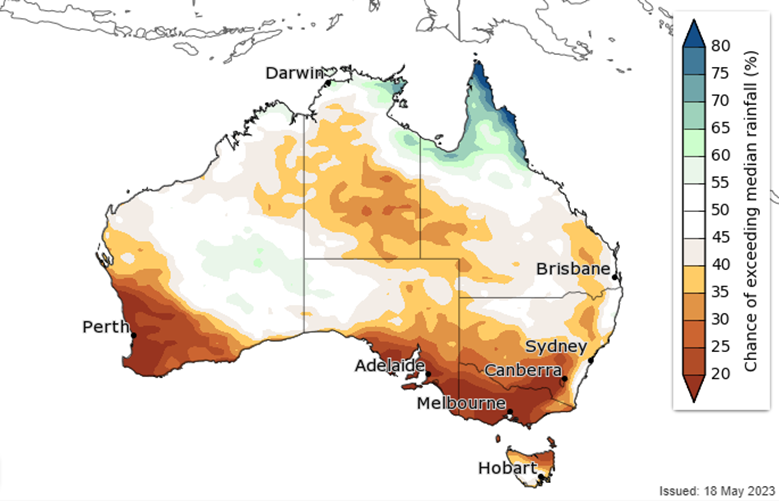

The outlook for rainfall over the three-month period from July to September (refer Figure 2) shows that most of the country is likely to receive around or below the median rainfall.

Figure 2: Chance of above median rainfall (July – September)

Source: Bureau of Meteorology

Near term outlook Insurance companies

Wet weather tends to be more detrimental from an insurance perspective than bushfires since the latter is typically localised in certain areas. However, under an extreme El Niño scenario it is still possible for insurers to experience higher than normal claims, with out-of-control fires over large, populated areas like we experienced during the summer of 2019/2020. On balance, it looks like we are in for a more favourable year for insurers, especially compared to the last three years.

Global warming and its subsequent weather impacts are a point of volatility and concern that insurers monitor carefully. There is little doubt that the severity and frequency of catastrophic weather events has risen due to global warming. However, the most recent years of heightened insurance claims activity has been more about the weather cycle.

La Niña potentially coming to an end after three straight years would represent a rather positive development for the insurance sector. While there is an increased chance of El Nino, outside of an extreme El Nino event, the insurers are likely to experience more favourable conditions – and fewer claims – than they have experienced over recent years.

The combination of elevated premium rates in response to recent weather events, and significantly higher interest rates, has materially improved the outlook for insurers profitability. Normalisation in claims activity due to an El Nino event that reduces storms and rainfall will only add to the improved outlook.

Conclusion

Given this improved outlook for insurers, Tyndall has an overweight position in QBE Insurance, which has a global focus, as well as a domestically focussed insurer, Suncorp. We expect these companies to outperform in the medium to long term given this positive backdrop, which, in our view the share market has not priced in properly.