Aussie equities is all we do

Our single-minded focus on Australian small company equities helps us deliver repeatable, sustainable and consistent investment outcomes for our clients.

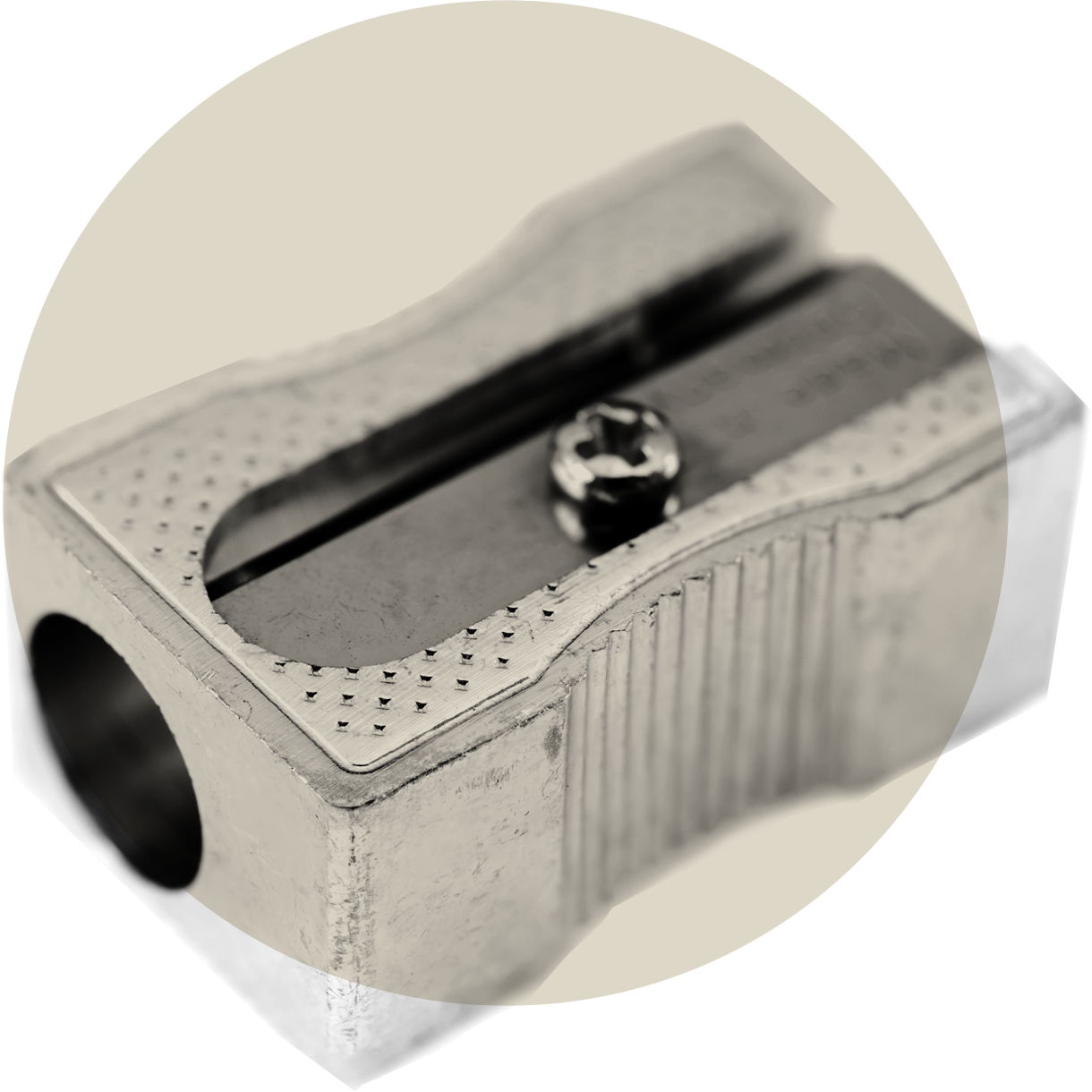

Uncovering hidden gems

Fundamental research and a unique stock ranking model enable us to identify ideal buying opportunities.

A thoroughly invested team

Our senior team of small cap investment professionals has an aggregate 75 years industry experience.

A sharper focus

We have a dedicated focus on Australian small cap equities, with a strong track record of outpeformance.

What gives us our edge?

We’re at home with taking strong active positions in undervalued securities to deliver higher returns with acceptable risk. We do this by applying our rigorous fundamental research, sharing insights and ideas, running objective corporate valuations, and overlaying our unique multi-layered analysis model.

We can deliver a value premium with lower volatility compared to other managers

Capturing alpha

Focused solely on an intrinsic value philosophy which uncovers undervalued and unrecognised opportunities in the Australian equities market with the aim of capturing excess alpha.

1. Fundamental research

We complete detailed fundamental analysis on the stocks and sectors in our universe, incorporating analysis of risks, opportunities, and ESG factors to drive our stock valuation.

2. Stock ranking model

Our proprietary quantitative ranking tool provides a comprehensive return forecast for each covered stock, encompassing capital gains, dividend income, and franking credits. This enables us to compare stocks across the market in terms of relative value.

3. Stock risk assessment

Stocks are vetted for earnings risk, balance sheet risk, industry and structural risk, ESG issues, and are subjected to scenario analysis to assess upside and downside outcomes.

4. Portfolio construction

We use a portfolio risk model to assess and manage aggregate portfolio risk and any unintended biases to build a high-conviction, diversified portfolio of quality companies.

SIGN UP TO INSIGHTS AND NEVER MISS AN ISSUE

If you haven’t already, subscribe to Insights to get all the latest news from the team behind our Australian equities funds.

How to invest

For any enquiries in relation to our products, please contact Investor Services on 1800 034 494.