The New Zealand economy faces challenges on multiple fronts. With uncertainty at peak levels, there certainly appears to be a challenging to economic recovery in the land of the long white cloud.

Having once been a regular visitor to New Zealand, this was my first trip back since the pandemic. Where I once was impressed by the level of economic and political sophistication, I was greeted by an economy which is weaker than I expected, is potentially still getting worse, and has limited visibility on the timing of any potential recovery. The political environment of the last few years certainly does not appear to have assisted.

Uncertainty “challenging” for the Land of the Long White Cloud

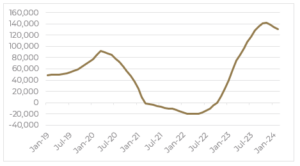

The New Zealand economy is facing challenges, with a clear sense of uncertainty apparent amongst businesses and consumers. I was struck by the severity of the downturn, especially in comparison to other developed countries (refer Figure 1) given that NZ’s monetary policy has not been significantly different.

Figure 1: NZ GDP faring worse than other countries

Source: ABS, Australian National Accounts: National Income, Expenditure and Product, Dec 2023.

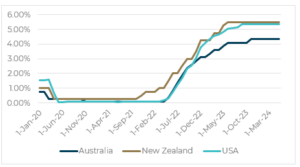

While admittedly its rates are amongst the highest globally (refer Figure 2), the severity of NZ’s downturn appears to be a function of the longevity of fiscal stimulus and prolonged supply constraints resulting from border closures. These factors have seen inflation spiral out of control (refer Figure 3), driving aggressive monetary tightening from the RBNZ to try and turn around an economy clearly in the midst of a recession.

Figure 2: NZ interest rates are elevated relative to peers

Source: RBNZ, May 2024.

Figure 3: NZ inflation remains stubbornly high

Source: ABS, Consumer Price Index, Australia March Quarter 2024

The economic outlook suggests that things will get worse before they improve, with conventional wisdom suggesting the impact of the RBNZ’s last rate hike in May 2023 has not yet been felt. And while it was hoped the change in government would provide an economic catalyst, a period of review by the new government has probably only added to the uncertainty.

The 30 May budget might improve sentiment, but it seems only a rate cut will make any significant difference. However, inflation remains above the target band (1-3%), meaning rate cuts are likely off the table for now. Consensus seems to be for the first rate cut to come in Nov 2024 or Feb 2025, with around 175-225bps of cuts baked into consensus through the balance of CY25. This is in stark contrast to RBNZ’s public forecasts, which suggest rates won’t be cut until 2Q25.

Other potential catalysts which appear likely to play second fiddle to the trajectory of rates include strong net overseas migration (Figure 4), potential personal tax cuts, and changes around investment property and interest tax deductibility.

Figure 4: NZ net overseas migration at record levels (annual)

Source: Stats NZ, May 2024.

A construction sector backlog and looming downturn

Against this backdrop, the construction sector is unsurprisingly facing a downturn with many companies we met experiencing a sharp decline in activity. Sentiment is a clear concern, dragged by high interest rates and government project reviews and cancellations.

The outlook for infrastructure construction is mixed. While there is a strong need for infrastructure spending, particularly in maintenance, the current environment is characterised by delays and funding uncertainties. The new government has changed directions on several projects, including the inter-island ferry, Auckland light rail, and water spending. Local governments are also facing challenges, with challenges on both the cost and revenue side further complicating infrastructure development. The consenting costs for projects have increased significantly, leading to discussions around resource management and the need to demonstrate value.

Commercial construction activity is also soft, with a weak economy impacting investment. When a recovery does eventuate the manufacturing sector is expected to be the first to recover, benefiting from a weak New Zealand dollar.

The residential construction sector is facing its own challenges, with home sales significantly down amongst the companies we met. Land sales almost seem non-existent in key markets such as Auckland, with sellers and buyers a long way apart on price expectations. While the reintroduction of interest deductibility and adjustments to the bright-line capital gain tax test are positive changes and may see investor sentiment improve, it is more likely at the margin.

The flood of immigrants is also not expected to deliver any short-term boost, with most likely to remain in the rental market for several years before being in a stronger financial position to buy a home. While the pipeline in residential consents is expected to support activity, the recovery in this sector is anticipated to be gradual.

As value investors we have an obvious interest in Fletcher Building (FBU), a company which has faced various challenges over recent times and currently sits at 20 year+ lows. Is the company merely stuck in a cyclical downturn which at some point will turn? Or has it become a value trap, with fundamental structural issues meaning the business won’t be as profitable as it has been in the past?

Recent management change and complexity around the turnaround give us little confidence in FBU at this time. Driving past the convention centre in Auckland it certainly appears there is lots of work to do – industry gossip is suggesting it won’t be finished by the end of this calendar year as promised. Others were questioning the outcomes around the WA Iplex pipe issue. There was little discussion around the Tradelink sale, although some suggestion there is plenty of interest at potentially higher-than-anticipated prices. On that point I’m not holding my breath.

Conversely, a visit to Tauranga and the new Fletchers Winston Wallboards plant was a highlight. While the NZ$400m price tag seemed high, they certainly have a well located, modern, and well organised manufacturing and distribution facility which will offer earnings leverage as utilisation improves. Finally, it seems on the ground in New Zealand there is a strong preference for new FBU management to be local, with a strategy of pulling right back to the core NZ businesses. This is a strategy which seems to have worked quite well for Boral – only time will tell whether the company will enjoy similar success.

A road to economic recovery

New Zealand’s economy is facing a challenging period, with a combination of factors influencing its trajectory. The road to recovery will be gradual, and it is likely that things will get worse before they improve.

In this context, navigating the potential investment opportunity in New Zealand exposed stocks requires finding a careful balance between the medium-term value opportunity and the shorter term more volatile sentiment and liquidity challenges. For now, we are standing back and will remain in the wings for the right entry point.