As global warming continues, so does the risk of severe weather events. What’s the long-term impact on the insurance sector due to rising natural peril claims, and ultimately, who ends up paying for them?

Global warming’s impact on the insurance sector

In early November 2021, both IAG and Suncorp announced a surprisingly large run of natural peril claims (insurance claims from significant weather/seismic events) for the four months to 31 October.

This increase in claims was well above each company’s run-rate allowance and reflected a period of unexpected weather events. The market became concerned that there was more to come, especially with the upcoming peak storm season during the Australian summer.

While some of these weather events are attributed to weather cycles such as El Nino / La Nina and the Indian Ocean Dipole (IOD), there is still an underlying increasing trend in the severity and frequency of these weather events due to climate change.

This issue brings us to discuss the risks that general insurance companies, such as IAG, Suncorp, and QBE face when pricing insurance policies in this environment.

It’s getting hot in here

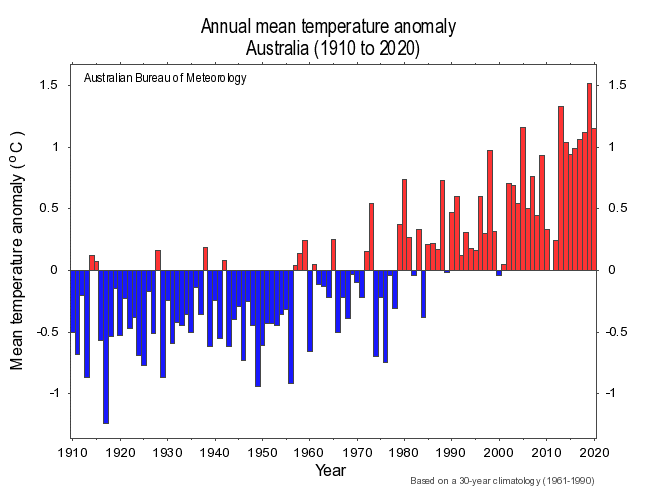

Chart 1. Rising annual mean temperature in Australia 1910-2020

Australia has warmed meaningfully by 1.0 – 1.5 degrees Celsius since around 1960. The last eight years to 2020 have been among the warmest since 1910. Data from the National Oceanic and Atmospheric Administration (NOAA) shows deviations in global mean temperatures, illustrating that the 19 years from 2002 to 2020 rank among the 20 warmest since measurements began.

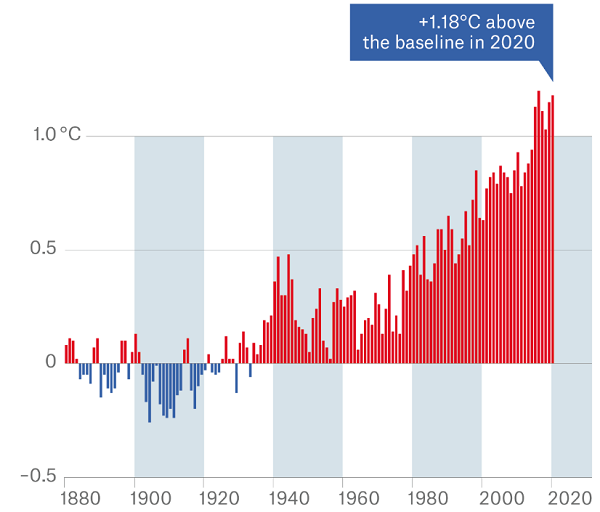

Chart 2. Deviations in global mean temperatures

Many experts estimate that global warming could reach 1.5 degrees Celsius within this decade, and 2 degrees Celsius by 2035. Globally, this will result in rising sea levels, with melting ice sheets and glaciers set to create even more extreme weather events such as drought, storms, and floods.

Over the last 20 years, we have seen global sea levels rise by approximately 3mm per year. These rising levels have resulted in more intense coastal erosion from storms, bringing a range of implications for coastal infrastructure and homes on the coast.

Global warming has also resulted in an increased supply of moisture in coastal regions and has contributed to the increased frequency and severity of thunderstorms (including hailstorms).

Climate change is driving increased insurance payouts

These conditions have seen general insurance companies in Australia facing unprecedented levels of natural peril claims in recent years, with earnings (and share prices) of Australian-listed general insurers negatively impacted by claims rising above allowances.

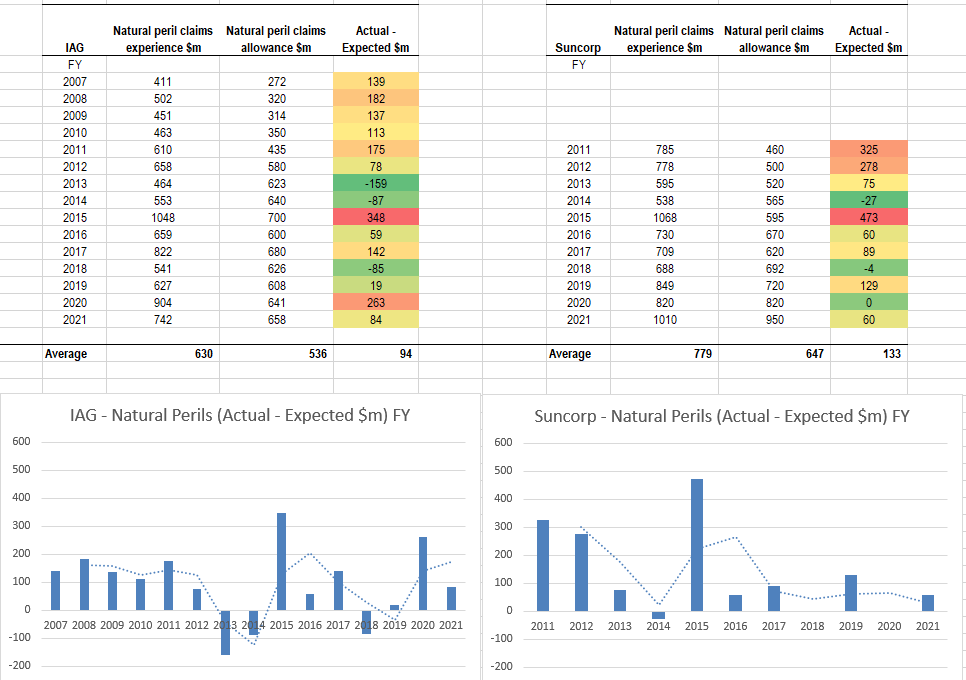

As chart 3 shows, both IAG and Suncorp, Australia’s two largest general insurers, have steadily increased allowances for natural perils claims over the past 10-15 years. Despite this, natural peril claims have generally still come in above these higher allowances. While inflation explains part of the increase, the overarching driver of these rises in claims is the increasing severity and frequency of natural perils.

Chart 3. IAG and Suncorp’s allowances for natural perils claims

Note: IAG has put in place quota-share reinsurance in recent years, resulting in IAG effectively transferring 32.5% of their insurance exposure to reinsurers in return for an exchange commission. This explains why their allowance for natural perils declined in 2016, 2018, and 2019 as these quota-share arrangements became effective.

Typically, drier weather such as El Nino or positive IOD should result in lower claims given these conditions are generally associated with fewer storms and floods (which offsets the damage from bushfires). However, this has not been the case recently.

The Australian summer of 2019/2020 highlighted that warm, dry events are becoming more extreme, with this increase in the spread and severity of bushfires resulting in higher loss of lives and significant economic impact.

There are many consequences of climate change, and they are diverse. The physical changes in weather patterns in terms of the severity and frequency of weather events have resulted in rising material damage to property, infrastructure, and significant agricultural losses. This has had a significant impact on Australia’s general insurers and will be increasingly relevant over time as these losses continue to mount.

Naturally, insurers have made increased use of reinsurance (insurance for insurers) to help lessen the impact of such events. However, insurers are finding that reinsurance coverage is getting more costly and, as a result, have generally retained more natural perils risk.

Insurers have allowed for the increasing cost of all this by steadily increasing insurance premium pricing. To the extent that this does not impact volumes, rising premium prices help insurers to increase top-line revenue.

What else are the insurers doing?

Australian insurers and their industry body, the Insurance Council of Australia, have continually been publishing and promoting research and statistics on the effects of climate change. They have been lobbying governments to build flood mitigation infrastructures (such as levees), improve planning and zoning around areas prone to natural perils, improve building standards, as well as lobbying for better bushfire mitigation strategies. Insurers have also increasingly looked to change their universe of investable companies, narrowing the industries they will continue to insure based on environmental considerations.

As a result of these lobbying efforts, there have been some changes. We have seen improved building standards in some areas that are prone to natural perils. In 2013, the Victorian government changed how it collects the Fire and Emergency Services Levy. This now more equitable approach uses property council rates instead of via a property insurance levy which disproportionately impacted the affordability of property insurance. NSW remains the only state that continues to charge this levy on property insurance premiums.

Who ultimately ends up paying for increased insurance claims?

The ultimate outcome will be one where the policyholders (i.e. those buying insurance) pay for the impact of climate change through continually rising insurance premiums. Alternatively, some may look to retain greater risk (i.e. insure less via higher excesses, or not being insured) due to increased insurance costs.

This will lead to increasing concerns about the affordability of insurance, and the rising risk of the public being underinsured or not insured at all, bringing significant consequences over time for Australia’s broader community.