Tesla claims it will eliminate the use of Rare Earths in its Electric Vehicles. Portfolio Manager Jason Kim investigates how realistic this claim is, drawing on insights from Adamas Intelligence, a leading research consultancy on critical minerals, and industry consultant Yoo Cheol Kim (YC Kim).

During Tesla’s 2023 Investor Day in March, the global electric vehicle behemoth claimed that their next generation electric vehicles (EVs) will no longer contain rare earths. Rare earths are used in some permanent magnets that are a critical component of motors in electric vehicles. These magnets contain rare earths called NdFeB magnets (Nd – the rare earth elements Neodymium and Praseodymium, in conjunction with some Terbium and Dysprosium, Fe – Iron – and B – Boron).

Tesla CEO, Elon Musk, is known for making hyperbolic statements and although his statement contained no details on how this would be achieved, the impact on rare earths stocks was immediate and dramatic.

Lynas, a large producer of rare earths listed on the ASX, saw its share price decline by almost 7% on the day, with further declines over the subsequent three weeks – a cumulative 23% decline during March alone (although part of this decline may also reflect the coincident announcement of an increased Chinese production quota of rare earths). Similar declines were seen elsewhere, including in China, the dominant producer and processor of rare earths, with key stocks in China falling anywhere from 4% to the daily limit of 10% on the day after Tesla’s statement.

Ferrite Magnets – the only feasible option currently

Tesla had previously used AC induction motors (with no rare earths) in their earlier models but replaced them with permanent DC magnet motors which contained rare earths (NdFeB magnets). Tesla’s decision to switch away from AC induction motors was driven by a range of factors, including problems with unbalanced voltage supply, rotor locking, and interference with the complex network of sensors found in modern vehicles. In light of these challenges, a number of experts in the field of EVs and rare earths predict that Tesla will not return to using AC induction motors.

According to Adamas Intelligence, the only current feasible alternative to rare earth-containing magnets is ferrite magnets. Moreover, ferrite magnets are currently being used by Proterial (formerly Hitachi Metals) in its latest EV motor design and have previously been used in vehicles such as GM’s 2016 Chevy Volt. Germany’s BMW has been active in steering away from rare earth magnets, with the company prompted to reduce its rare earths consumption to limit over-reliance on Chinese-based supply chains given growing geopolitical tensions.

However, while ferrite powered motors can match the performance of NeFeB powered motors to some extent, this performance comes with a significant weight and efficiency penalty that has made the switch unattractive to date. This means that the manufacturer must accept a reduced driving range or an additional cost for a larger battery to maintain the driving range. There is also the issue of a material reduction in torque with the ferrite powered motors. Given the bigger batteries, as well as more copper required, some experts believe there is no material cost advantage to using ferrite powered motors to NdFeB powered motors.

Why is Tesla looking to stop using Rare Earth (NdFeB) powered motors?

Tesla’s move reflects concerns that there is insufficient supply of rare earths to meet the projected demand for EVs over the coming years.

Rare earths industry consultant, YC Kim, subscribes to this view. He has stated that the global EV market is projected to grow from 8.2 million units in 2022 to 39.2 million units by 2030, a nearly 5-fold increase in eight years.

Tesla produced 1.4 million units in 2022, accounting for 17% of all EVs, and recently reiterated its target to sell 20 million EVs annually by 2030. If these numbers are correct, then Tesla’s market share in global EV sales will grow from 17% to just over 50% by 2030. This is very ambitious. Even if Tesla only maintains its current market share, then based on 39.2 million units globally by 2030, Tesla would produce 6.7 million EVs p.a. by 2030 or roughly fivefold 2022 production levels.

While these numbers are forecasts and subject to significant uncertainty, there is little doubt that the switch away from internal combustion engine (ICE) vehicles is accelerating. The result will be an increase in demand for EVs such that production volumes will be multiple times higher by the end of the decade.

Given Tesla’s ambition to grow its market share in EVs over time, they will feel this shortfall in rare earths supply acutely.

In 2022, Adamas Intelligence data indicates that passenger EV motors were responsible for 12% of global NdFeB magnet consumption.¹

According to YC Kim, if global EVs production grows to 39.2 million units by 2030, then EVs will account for roughly 50% of the NdFeB magnet consumption in 2030. This would see total demand for NdPr (Neodymium and Praseodymium) growing to almost four times its current size by 2030.²

Where will all these Rare Earths come from?

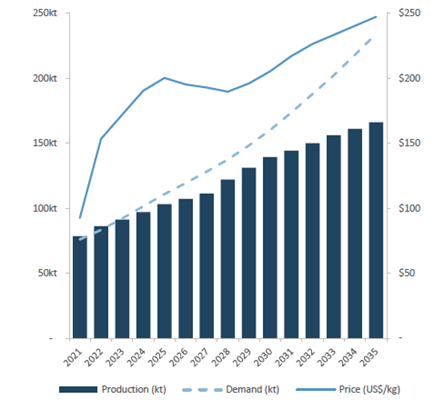

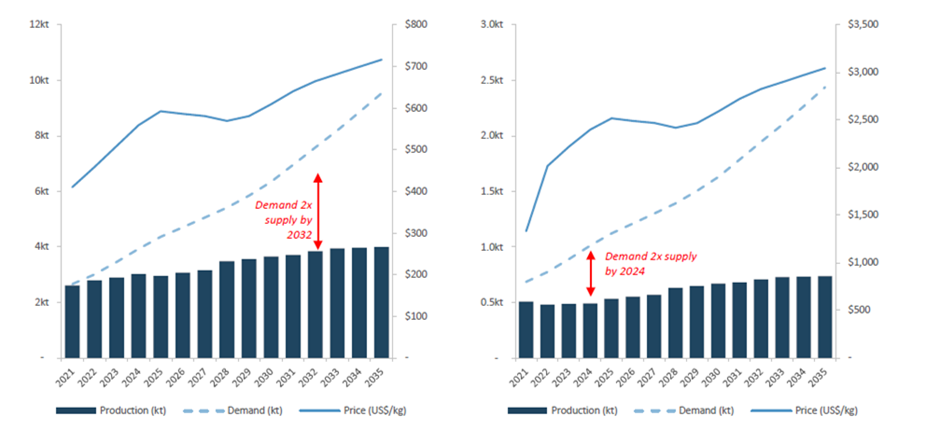

This fourfold increase in demand for rare earth minerals appears difficult to satisfy based on current supply forecasts. Indeed, the supply-demand forecasts of both Adamas Intelligence and YC Kim indicate a substantial shortfall in the supply of these rare earth elements (refer Figures 1 and 2).

Figure 1: NdPr demand-supply balance (LHS) vs price (RHS)

Source: Adamas Intelligence, and Australian Rare Earths Ltd.

Figure 2: Dysprosium and Terbium demand-supply balance (LHS) vs price (RHS)

Source: Adamas Intelligence, and Australian Rare Earths Ltd.

This supply shortfall will be very positive for pricing, as higher prices will be necessary to incentivise new supply to come to market.

If Tesla wants to meet its target, it is clear that based on current supply forecasts, there simply won’t be enough rare earths to produce their targeted number of EVs using NdFeB powered motors.

YC Kim’s discussions with major auto manufacturers suggest the first preference is to use NdFeB powered motors. He is of the view that while ferrite powered motors will work, given the significant trade-offs, they will only be suitable for lower priced mass market cars. It is simply a matter of rationing the limited supply of rare earths.

YC Kim is also concerned that the growing demand for EVs within China could result in the cessation of rare earth exports as soon as 2025. Further, China has issues with its own supplies currently and has stepped out to neighbouring countries such as Myanmar (via China-controlled entities) to produce rare earths. This looming supply shortfall and potential cessation of Chinese supply has not gone unnoticed by Western governments, as detailed by Stefan Hansen in his note The Value in Securing Critical Mineral Supplies.

Conclusion

Despite Tesla’s ambitious claim that it will cease using rare earths, it appears the demand for rare earths will continue to grow and that supply growth still remains an issue. This will most likely result in the various industries increasingly using lower quality alternatives purely out of necessity and not out of choice.

There are some possible advancements that may result in true alternatives to rare earths in motors, such as manganese bismuth magnets. However, they are all still in their development infancy, and their commercialisation, if they prove to work, is still several years away.

Iluka Resources, which is predominantly a mineral sands miner with a very large presence in titanium dioxide and zircon markets, has been a beneficiary of government support aimed at increasing the supply of critical minerals including rare earths. This support will assist in the acceleration of Iluka’s emerging, but potentially very large, rare earths mining and processing business.

As we transition towards a net-zero world while being in a period of heightened geo-political tensions, Tyndall AM believes that Iluka Resources offers a unique and undervalued opportunity. The market has not fully understood the potential upside from their rare earths opportunity, and the significance of the government support that this project has received.

References

- Adamas Intelligence, Implications: Tesla Announces Next Generation Rare-Earth-Free PMSM. 2 March 2023: https://www.adamasintel.com/tesla-rare-earth-free-motor/

- Kim, ‘YC’, CSLA, Rare Earths Call, Exploring Tesla’s Ambitions for Rare Earth-Free EV Motors, 22 March 2023