With mounting pressure on banks to reduce their exposure to funding fossil fuel companies, the four majors have introduced a number of ambitious measures to meet their climate targets. What are the implications for the industry and does this mark the end of coal-fired power plants?

The Paris Agreement

The Paris Agreement entered into force on 4 November 2016 after at least 55 parties (countries) that make up at least 55% of global emissions ratified the agreement. Subsequent to the initial threshold being reached, 169 countries, including China, India, the European Union and New Zealand, have ratified the agreement. The US initially was part of the agreement but notified the UN that they would withdraw from it as soon as it was eligible to do so—effectively November 2020. President elect Joe Biden has indicated that they will reenter the agreement.

The Paris Agreement’s primary aim is to ‘Strengthen the global response to the threat of climate change’. The stated goal in article 2 of the Agreement is to limit the increase in global temperatures to ‘well below 2°C’ above pre-industrial levels. The Intergovernmental Panel on Climate Change (IPCC) suggests that global warming greater than 2°C would have serious consequences, including an increase in the number of extreme weather events.

In the lead up to the Paris Conference of Parties (COP), countries submitted Intended Nationally Determined Contributions (INDC) that set out each party’s plans for addressing climate change, including a target for reducing greenhouse gas (GHG) emissions, and how the target would be achieved.

Australia’s INDC states that GHG would be reduced by 26 – 28% below 2005 levels by 2030. Other commitments include doubling Australia’s renewable energy capacity, helping to improve energy productivity by 40% by 2030, and investing in innovation and clean technology.

Comparing the targets of countries is complicated given the use of different baseline years and target years. In addition, countries are commonly changing the targets and target years with differing governments. For example, some initial targets are below:

- New Zealand announced a target of 30% below 2005 levels by 2030.

- The EU pledged a target of 40% below 1990 levels by 2030.

- The US announced a target of 26 – 28% below 2005 levels by 2025.

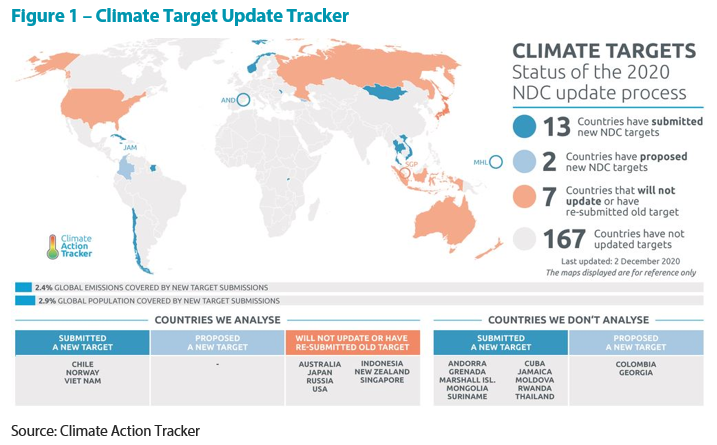

Climate Action Tracker (CAT) documents the changes countries make regarding their climate targets (see Figure 1). Australia has confirmed that they will not submit a new target for COP26 but an INDC is planned for 2025, including a target for 2025 or 2040.

Task Force on Climate related Financial Disclosures (TFCD)

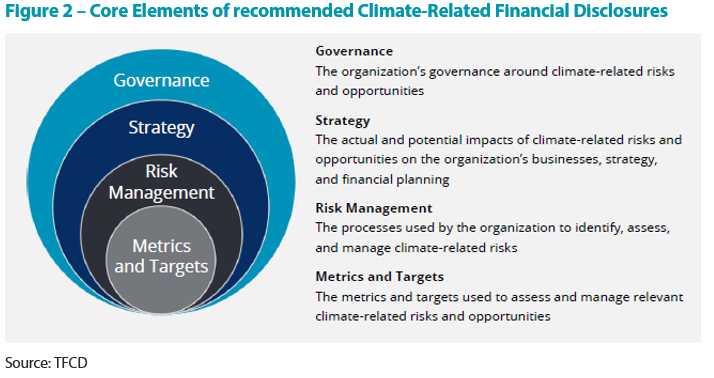

The TFCD recommendations are intended so companies can produce useful, forward-looking information that can be used in financial reporting. There is a strong focus on both the risks and opportunities that relate to the transition to a lower-carbon economy.

APRA notified institutions that they must regard climate change as fundamental to risk management but has yet to introduce formal climate risk reporting rules. Financial institutions have preempted any potential mandatory rules from the regulatory body by setting up the Climate Measurement Initiative in September 2020. This is a collaboration between banks, insurers and climate scientists to publish a comprehensive climate change reporting framework. This framework expands on the TCFD framework and enables companies to assess emerging risks that accompany climate change that is more appropriate for the Australian market.

All four major Australian banks report to TCFD recommendations which makes it easier to measure and compare companies on a like-for-like basis. Nikko AM actively encourages companies during our engagements to report under this framework.

The days of banks funding fossil fuels are coming to an end

All four major Australian banks, as part of their commitment to reduce Scope 1, 2 & 3 GHG emissions, are reducing their exposure to funding fossil fuel companies. The disclosures are all slightly different but essentially aim to reduce and finally eliminate all funding of thermal coal mining and coal-fired power generation.

Part of the process is to engage with customers to help reduce the exposure and to provide a pathway to transition away.

ANZ

ANZ supports the Paris Agreement goal of transitioning to net zero emissions by 2050. The company has a number of priority areas including:

- Increasing and broadening engagement with the largest emitting customers to include major oil and gas companies to support them to establish and build out their transition plans by 2021.

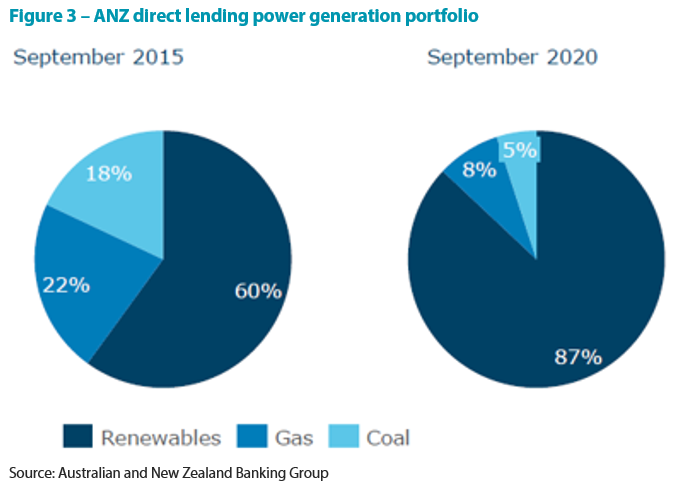

- Further reduce carbon intensity of their electricity generation portfolio by only directly funding to low carbon gas and renewable projects by 2030. Continue to support diversified customers, but no longer banking any new business customers with thermal coal exposures.

- Engaging with existing customers with +50% thermal coal exposures to support diversification plans. The expectation is to develop specific time bound and public diversification strategies by 2025.

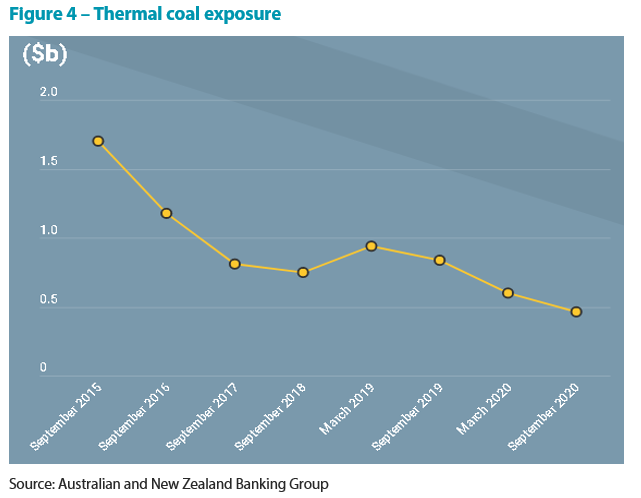

- Not directly financing any new coal-fired power plants or thermal coal mines, including expansions. The existing direct lending will run off by 2030.

- Financing only new large-scale office buildings that are highly energy efficient.

- Accelerating their own emissions reductions by sourcing 100% of their electricity needs from renewables by 2025.

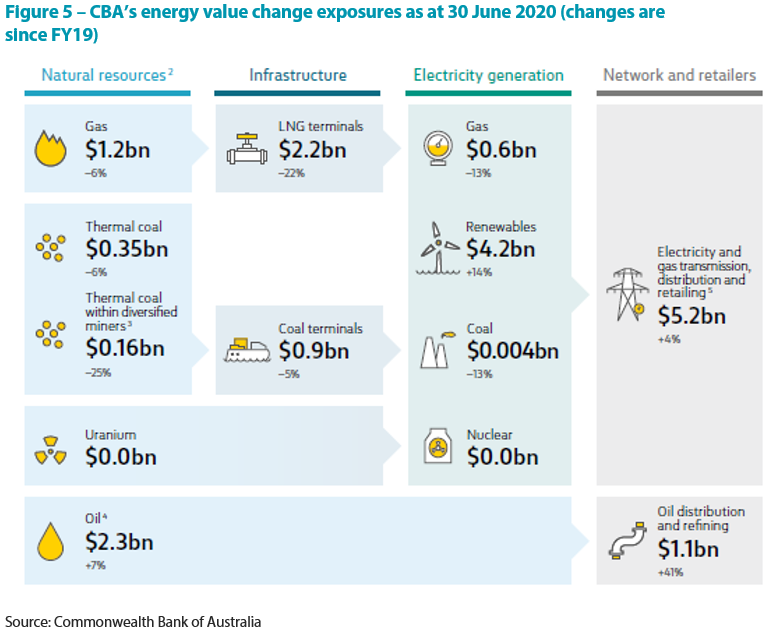

Commonwealth Bank

- CBA is committed to reaching 100% of their electricity needs from renewable sources by 2030.

- CBA is committed to setting science-based emissions reduction targets for Scope 1 & 2, as well as Scope 3 emissions.

- CBA is continuing to reduce exposures to thermal coal-fired power stations and thermal coal mines with an aim of exiting the sector by 2030—subject to Australia having a secure energy platform.

- Provision of banking and financing to new oil, gas or metallurgical coal projects if supported by an assessment of the environmental, social and economic impacts and if in line with the goals of the Pairs Agreement.

- CBA is supporting gas as a transition fuel.

- In 2017, CBA set a target of making available $15 billion of funding by 2025 to projects with a low carbon footprint. Projects eligible include renewable energy, 6-star rated green buildings, energy efficacy projects and low carbon transport.

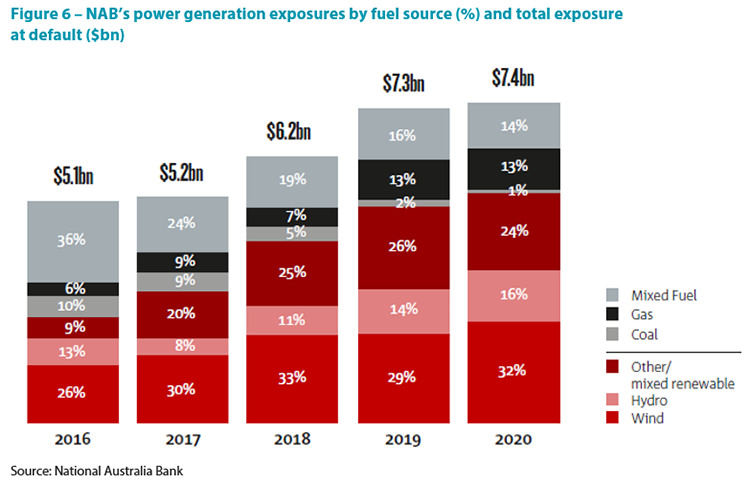

National Australia Bank

- NAB will source 100% of their energy requirements from renewable sources by 2025. A science-based target has been set to reduce GHG emissions by 51% by 2025.

- NAB is one of 38 banks globally to sign the Collective Commitment to Climate Action (CCCA). The CCCA is an independent initiative of the Principles for Responsible Banking (PRB) that sets out concrete and time-bound actions that banks will align their lending with the objectives of the Paris Agreement.

- NAB is committed to achieving a Paris Agreement aligned net zero emissions lending portfolio by 2050. Environmental financing target of $70b by 2025 ($42.5b currently).

- Thermal coal mining exposures are capped at September 2019 levels with a 50% reduction of coal mining financing by 2028 and thus effectively zero by 2035. No new-to-bank thermal coal customers will be brought on.

- NAB is supporting current coal-fired power customers to implement a transition strategy that is aligned with the Paris Agreement goals of a 45% reduction in emissions by 2030 and net zero by 2050.

- The company will work closely with their 100 largest GHG emitting customers to support them in developing and/or improving low carbon transition plans by 2023.

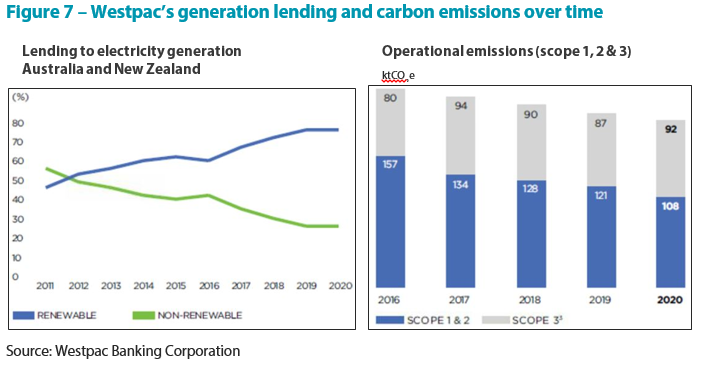

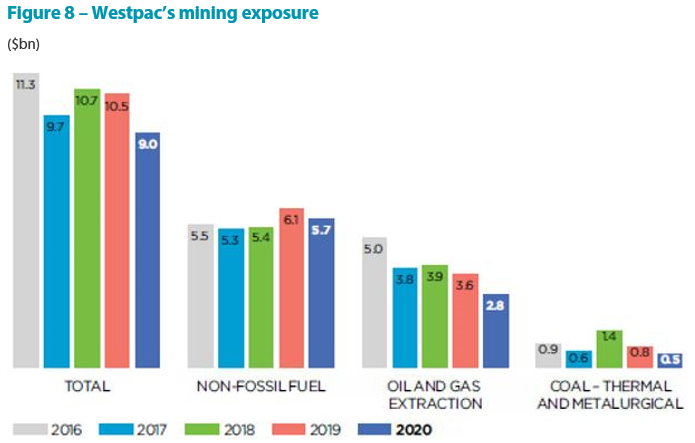

Westpac

- WBC is aiming to source the equivalent of 100% of their global electricity consumption through renewable sources by 2025.

- WBC aims to provide $3.5b of new lending to climate change solutions by 2023 and $15b by 2030.

- Reduction of Scope 1 & 2 emissions by 85% by 2025 and 90% by 2030 using 2016 as a base year. In addition, reduce Scope 3 supply chain emissions by 35% by 2030.

- Will provide funding for metallurgical coal production but will support technological solutions to reduce the steel industry’s dependence on coal—hydrogen anyone?

- WBC will not be providing finance to oil and gas exploration in frontier regions such as Arctic and Antarctic given the perceived high risk.

What are the implications?

The obvious implications of banks stopping, reducing and phasing out the funding of thermal coal and fossil fuel projects is that the cost of capital increases as financing costs rise given the reduced supply of funding. Many super funds have stopped investing in thermal coal exposed stocks and thus availability of equity is also reducing and/or becoming more expensive. Alternate sources of funding outside of Australia, and perhaps of a private nature, may become the norm. Perhaps further consolidation in the industry may eventuate.

The listed thermal coal industry within Australia is small at only around $5.5b with only Whitehaven, Newhope and Washington H Soul Pattinson. South 32 has a significant position in thermal coal assets in South Africa but has sold the assets to Seriti Resources. The transaction is essentially awaiting approvals from Eskom Holdings—the government-owned power utility that is the primary customer. South 32 will become more investable post the execution of the coal sale given many asset owners have excluded the company given the thermal coal exposure.

The opportunity set for the banks funding renewable projects is enormous as governments worldwide encourage and incentivise projects. The current exposure the banks have to coal and coal-fired power stations is very small and in most cases the renewable exposure is greater and growing quickly (refer to figures 3, 4, 5, 6 & 7).

Australian banks potentially fund international mining companies, e.g. Glencore and Peabody, which have operations within Australia. We believe this will reduce to zero over the short to medium term. Funding of the transportation infrastructure for thermal coal is also at risk. In our view, companies such as Aurizon Holdings that own and operate coal haulage operations in both Queensland and New South Wales are likely to have availability of funding reduced and asset owners excluding them from their investable universe. The upcoming IPO of Dalrymple Bay Coal Terminal is another infrastructure asset that is at risk. Nikko AM ensures that the life of coal assets and coal related assets expire by at least 2050 in line with the Paris Agreement zero emissions target.

Nikko AM has previously written about the impact of stranded assets in the context of coal fired power stations. Our assessment was that it was immaterial for Origin Energy (c2%) and modest for AGL (5 – 10%). The potential funding of any new coal-fired power stations within Australia is likely to be via government intervention. No current power generator is discussing building new coal-fired power stations as they are more focused on transitioning to renewables over time with gas fired power stations acting as firming capacity.

Important Information

This material was prepared and is issued by Nikko AM Limited ABN 99 003 376 252 AFSL No: 237563 (Nikko AM Australia). Nikko AM Australia is part of the Nikko AM Group. The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided.