A broadly held expectation is that the world will transition to net zero carbon by 2050, underpinned by the development of cleaner technologies including renewables. It would appear however that this expectation has been framed with little consideration of the capacity to deliver it. It is now becoming evident that there are significant capacity constraints, meaning renewables alone are unlikely to get us there. And several countries are now revising their plans in response.

Recently we have seen the UK delay critical climate change targets (link), Canada’s reacceptance of uranium-fueled nuclear power (link), while in Germany, an EU leader in the energy transition, the Minister for Energy and Climate Change recently confirmed the country’s current pace of solar roll out means they will fall short of what is required by 2030 (link). Underlying these announcements is a realisation that we are not transitioning fast enough to renewables and other energy sources are still required. We expect this theme to continue, with more nations to backpedal from ambitious targets as the science, economics and time to execute overwhelm these plans.

Here we discuss a few of the issues to generate further debate on this topic. While there is no clear-cut answer to this vexing issue, it is worth discussing some of the challenges and possible ways to get there as proposed by others.

A global mineral shortage

Simon Michaux, Associate Professor of Mineral Processing and Geometallurgy at the Geological Survey of Finland, looked at the issue of mineral supply.

Michaux is an Australian with a strong mining background. When he looked at the green transition back in 2015, Michaux noted there were no feasibility studies, no real numbers, just arm waving. There was a clear lack of discussion or awareness of the minerals’ intensity of renewables, and how the transition would take place.

Michaux’s calculations led him to conclude that the world did not have sufficient minerals to produce the first generation of renewables, let alone the replacements that are required since renewables infrastructure needs to be replaced every 10-25 years.

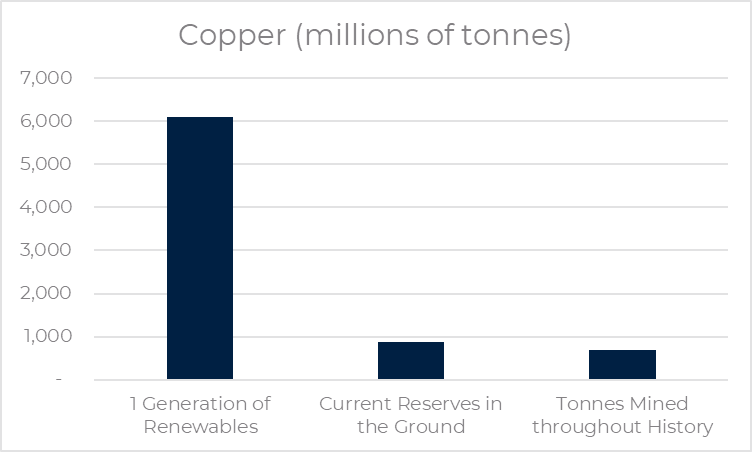

These mineral resources are finite and are becoming harder to find and more difficult to extract. Michaux used copper as an example, where he estimates that we need 6.1 billion tonnes of copper just to manufacture one generation of renewables. This is almost 9 times the amount of aggregate historical copper production. He also notes that the current measured reserves of copper in the ground (880Mt) represent less than 15% of the required amount (refer Figure 1).

Figure 1: Global Copper Shortage

Source: Simon Michaux, the Geological Survey of Finland, 2023.

How much renewable electricity do we need to replace fossil fuels?

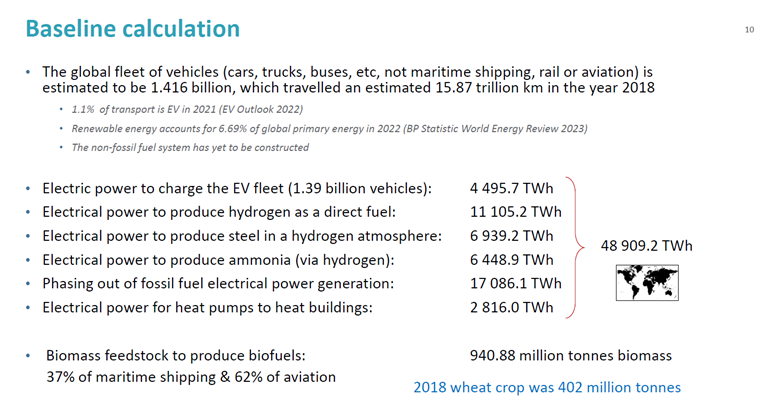

Of the current 27,000TWh of electricity generated (globally) each year (2018 numbers), ~9,500 TWh is from renewables. To ultimately replace fossil fuels, Michaux estimates that an additional 49,000 TWh of electricity p.a. from renewables (refer Figure 2). Separately, the IEA predicts that by 2050 the global electrical power grid will need total generation of 71,200 TWh, making this even more challenging.

Figure 2: Additional Renewable Energy Required to Replace Fossil Fuels

Source: Simon Michaux, the Geological Survey of Finland, 2023

Michaux has estimated that based on the additional 49,000 TWh of renewable energy needed on current numbers we will need the equivalent of 780,000 new power stations. This will largely be based on a combination of solar, wind with battery storage as well as pumped hydro. Michaux makes the point that the growth in pumped hydro will be severely limited due to the lack of fresh water available.

What are the other possible solutions?

Jermiah Josey, an engineer by background and a founding director of the Thorium Network, is a proponent of nuclear energy as part of the solution. Both Josey and Michaux are supporters of nuclear power, but more specifically liquid fission thorium for nuclear power. However, at this stage uranium nuclear power is far more advanced, and Josey argued that this should be rolled out, and that the negative sentiment attached to nuclear power is more myth than fact.

Critically, Josey notes the acceptance of nuclear in a number of other markets: 75% of France’s electricity needs are met by nuclear power, and in South Korea it accounts for 27%. China is currently at 5% but is rapidly expanding.

Josey points out the key myths holding back nuclear are the high costs and long lead times, fears of radiation, and concerns on waste. As a result there is excessive regulation in the West, and organised opposition to nuclear power.

Josey argues that the radiation exposure for those living near nuclear plants is very safe, and that the size of nuclear waste is actually very small (35 cubic metres) and would be smaller if the US reprocessed their waste to use again (as like most other countries do).

According to Josey, nuclear currently accounts for 5% of total energy supply (incl. transport fuels), and it does so at a far lower cost than even fossil fuels. If nuclear was to increase 20-fold to supply all of our energy requirements, Josey argues that it would reduce our energy costs by 97%, as well as being effectively emission free, and providing a reliable 24/7 base load that renewables cannot deliver.

Other possible solutions to throw in the mix include hydrogen, as well as carbon capture and storage (CCS) into depleted well proven gas reservoirs. Both options offer promising solutions, with CCS effectively prolonging the lifespan of our existing energy sources.

Conclusion: A mix of renewables and other solutions appears inevitable

It is abundantly clear that we don’t have the mineral resources necessary for renewables to be the primary solution to deliver on net zero ambitions by 2050. While renewables will remain part of the solution, it is apparent that we need to consider other alternative energy sources in combination.

Nuclear is already seeing a resurgence and it likely to play a bigger part going forward. While opposition remains a hurdle in many countries, its history of safe operation and reliable, low-cost, carbon-free generation in countries like in France and South Korea, highlights its appeal.

According to the World Nuclear Association, Australia has one of the worlds’ largest endowments of uranium and already produces about 10% of world’s supply, with most of this coming from BHP’s Olympic Dam as a by-product. With nuclear-powered submarines on order and destined for Australia by the early 2030s, which requires us to build the technical capability in-country, we could see Australia political landscape warm towards adding nuclear into the domestic energy mix.

In many ways, the momentum in hydrogen appears to have moderated, and seems far less likely to play a meaningful role in transport given electric vehicles have already taken the lead. That said, hydrogen may still play a meaningful role in heavy transport or possibly as a supplement to natural gas or for peak power generation.

While we are transitioning to whatever that future mix might be, we will remain reliant on fossil fuels for quite some time yet, and arguably for longer than we think as large populated emerging nations develop over time. Given this, CCS has arguably an important role to play for quite some time.

At Tyndall AM, we have recognised that the transition will be challenging given the constraints mentioned here. Further, the lack of investment in oil and gas production due to the transition will also create opportunities. Our portfolios have exposure to companies that are beneficiaries of the growth in renewables, as well as the higher quality energy stocks that are more exposed to natural gas via LNG, while having credible plans to deal with emissions via CCS and/or hydrogen developments.