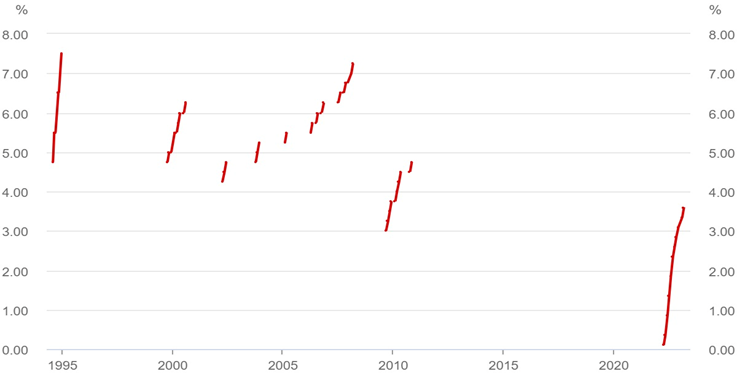

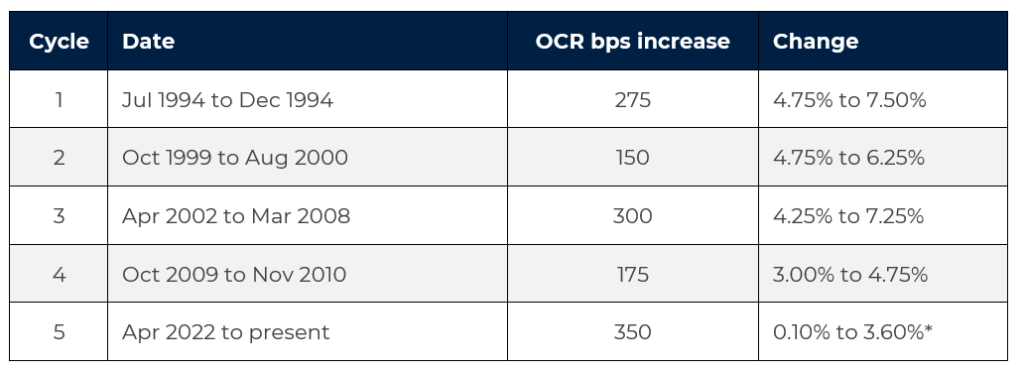

Over the last three decades there have been five Reserve Bank of Australia (RBA) official cash rate (OCR) tightening cycles (refer Figures 1 and 2).

Figure 1: RBA hiking cycles over the past three decades

Source: RBA

Figure 2: RBA tightening cycles (interest rate percentage change)

Source: Tyndall AM *as at April 2023

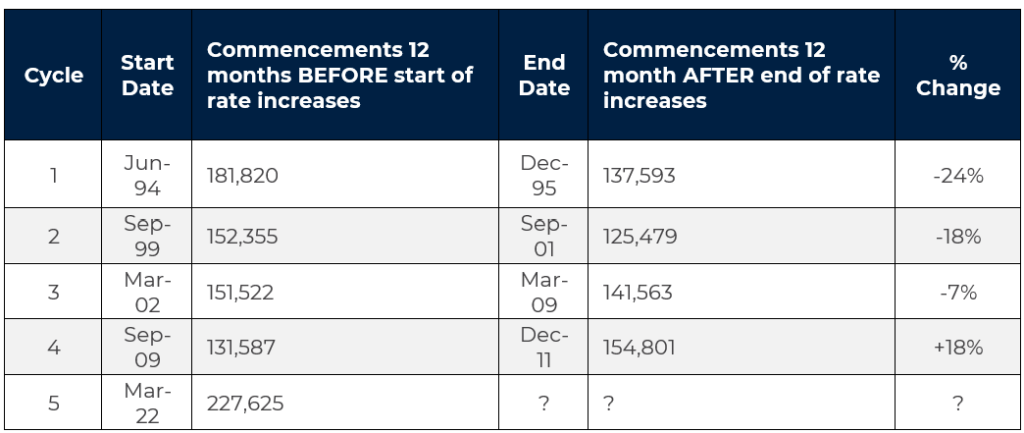

Unsurprisingly, total Australian housing commencements have responded to the RBA’s interest rate hiking cycle. Figure 3 shows the percentage change in housing commencements pre and post the RBA’s most recent tightening cycles.

Figure 3: Housing commencements pre and post RBA tightening cycles

Source: Tyndall AM

Ordinarily I might have expected a more consistent pattern (i.e. for all periods to be negative). However I make a number of observations from this data:

- Cycle 1 was driven by the RBA looking to reduce inflation after introducing the 2-3% inflation target in the early 1990s. This is a similar situation to today.

- Cycle 2 reflected the building industry hangover after the introduction of GST in July 2000.

- Cycle 3 was more elongated and arguably motivated by the RBA looking to reduce house price inflation, and was distorted by the GFC at the end of the cycle.

- Cycle 4 was also distorted by the GFC and several state and federal initiatives to encourage housing activity, in particular first homeowner grants increasing from $7k to $14k for an existing home and from $14k to $21k for a new home.

What is the likely impact of Cycle 5 on Australian housing commencements?

The answer seems to be exactly what you might expect. i.e. a drop of 30% or more.

We are starting from elevated levels thanks to the Australian HomeBuilder program, which saw Federal government grants of $25k to build a new home or substantially renovate an existing one. There were around 138k applications under the program. This is not dissimilar to the pull forward of activity we saw associated with the introduction of the GST. The RBA is also fighting a significant inflation battle as was the case in Cycle 1.

When we factor in: (i) the cost pressures being experienced by builders, (ii) labour availability issues, (iii) the lack of registered land, and (iv) the blowout in build times, a very significant pullback in activity appears likely. This will become increasingly evident in the back end of CY23 and into CY24.

Home sales data provides a useful guide as to what likely lies ahead. It typically takes 6-12 months for a home sale on a registered block of land to flow through to an approval, let alone a commencement. This timeframe can blowout significantly if the land is not registered. Housing sales data from the Housing Industry Association (HIA) confirms this.

While February 2023 home sales increased 14.3% compared to January, new home sales for the three months to February were down 46.8%. NSW was down a staggering 76.6% on the same time last year, which is not surprising given it is the most expensive market nationally and the most interest rate sensitive. Ultimately, Cycles 2 and 5 prove that you can’t party this hard without getting a hangover.

A fall of 40% in housing commencements would suggest commencements in the order of 136k, while a 30% decline would be around 159k. It’s worth noting the biggest ever annual decline seen in Australian housing starts was post the introduction of the GST: in the 12 months to June 2001, housing commencements declined 33%. That record certainly looks under threat given the dual impact of a pull forward in activity and a significant increase in interest rates.

The consensus view based on a number of market forecasts suggests a big correction in housing starts in FY23 (around -23%) and a smaller decline in FY24 (around -7%). While directionally this might be right, I suspect the pullback could be deeper and longer than is forecast. The risk for companies exposed to this sector is that consensus underestimates the earnings leverage with pricing (which recently has generally been strong, in line with inflation) becoming increasingly difficult to achieve in a much weaker demand environment

Eventually the clouds will clear from the valley

Despite the current challenges, the RBA will send a stronger signal that rate hikes are done and given the strong migration outlook and housing shortage this should underpin a return to stronger residential construction activity. Sensible government policy may also eventuate around ‘built-to-rent’ and social/affordable housing. Let’s hope the days of handouts and mis-guided tax incentives as has been the norm for both political parties over the past 25 years are over.

From Tyndall’s perspective, this scenario presents a challenge. While some of the impacted companies are suggesting value is emerging, the likelihood of a further downturn in activity and downward revisions to consensus expectations increase the risk of investing too early, or as we often caution, “on the wrong side of the valley.” Nonetheless, our exposure to the Australian residential construction sector remains limited, and we have no immediate plans to change this stance.

Our modest exposure comes through Reliance Worldwide (RWC), whose small Australian business derives roughly 50% of its revenues from new construction, representing about 5% of its total earnings. Our focus with RWC, however, lies more in its US and European exposures. We anticipate that significant value opportunities will emerge over the next 12-18 months, and we are closely monitoring the situation to ensure we invest “on the right side of the valley.”