With the upcoming Voice referendum in Australia, the nation stands on the cusp of a significant constitutional change, emphasising the acknowledgment of Aboriginal and Torres Strait Islanders as the original inhabitants and the establishment of an Aboriginal and Torres Strait Islander Voice to Parliament. Here we aim to assess Australian corporate performance in the context of the indigenous reconciliation journey, particularly focusing on Reconciliation Action Plans and their varying stages.

Reconciliation Action Plans

Reconciliation Action Plans (RAPs) seek to enable organisations to take meaningful action to advance reconciliation.

Based around the core pillars of relationships, respect and opportunities, RAPs aim to provide tangible and substantive benefits for Aboriginal and Torres Strait Islander peoples, increase economic equity and supporting First Nations self-determination.

The four stages of a RAP are as follows:

- Reflect: At this stage, organisations acknowledge the need for change and express their commitment to reconciliation. This stage, which normally takes around 12 months, involves building relationships and cultural awareness within the workplace.

- Innovate: The Innovate stage focuses on implementing specific initiatives and programs that promote meaningful engagement and partnerships with indigenous communities. This stage normally takes around two years.

- Stretch: Organisations at the Stretch stage are dedicated to integrating reconciliation into their core operations and actively seeking opportunities to advance indigenous participation, employment, and procurement. This stage normally takes around 2-3 years.

- Elevate: The Elevate stage signifies a comprehensive and sustained approach to reconciliation, incorporating significant changes in organisational policies, practices, and cultural competency, ultimately striving for measurable outcomes.

Corporate Performance and RAPs

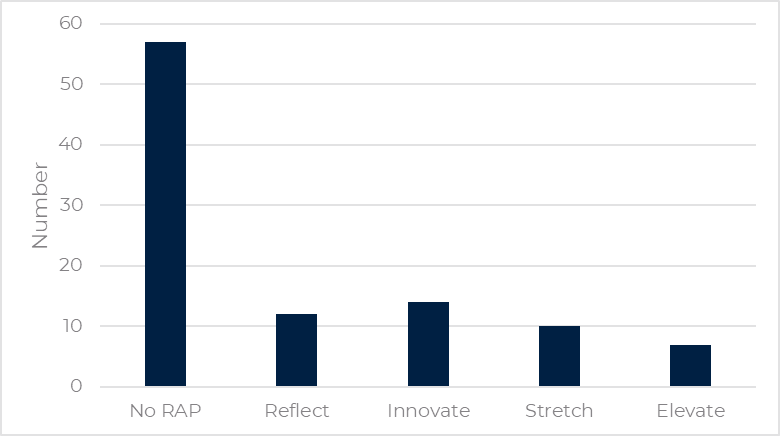

There are presently 43 companies in the S&P/ASX 100 with RAPs in place. These companies are distributed across the Reflect, Innovate, Stretch, and Elevate stages. Notably, 57 companies in the ASX 100 do not have RAPs, suggesting that there is room for growth in corporate engagement in indigenous reconciliation.

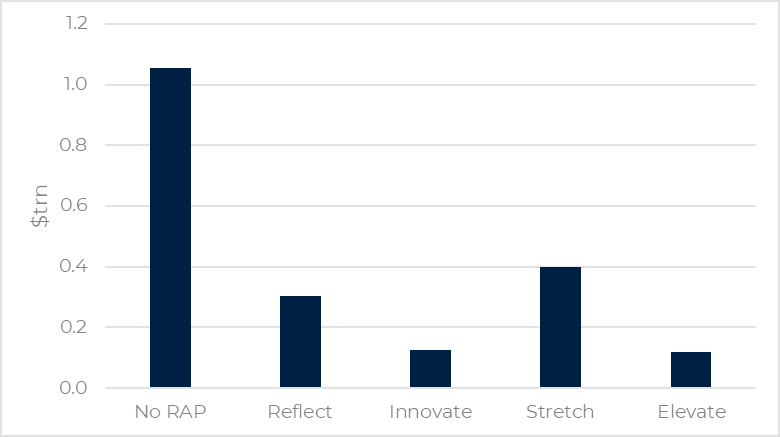

The breakdown of companies by RAP stage and their associated values in the ASX 100 is as follows:

- Reflect: 12 companies with a total value of $300 billion

- Innovate: 14 companies with a total value of $125 billion

- Stretch: 10 companies with a total value of $400 billion

- Elevate: 7 companies with a total value of $120 billion

Figure 1: S&P/ASX 100 RAP Breakdown (number)

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023.

Figure 2: S&P/ASX 100 RAP breakdown (total market cap)

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023.

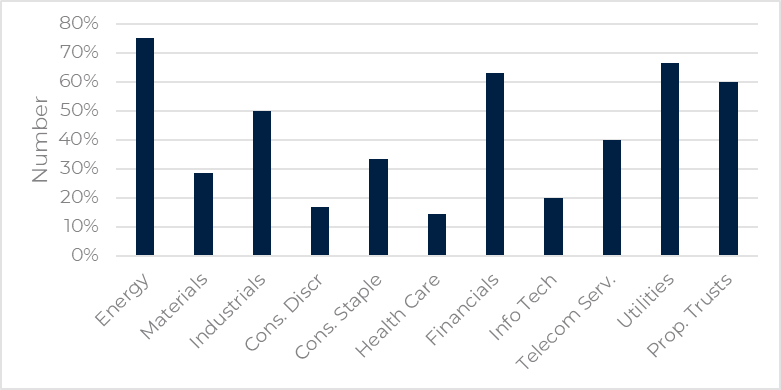

Additionally, sector-wise analysis demonstrates varying levels of engagement with RAPs:

- Financial sector companies exhibit substantial engagement, with 12 out of 19 companies having RAPs.

- The industrial and property trusts sectors also demonstrate significant engagement, with 7 out of 14 and 6 out of 10 companies having RAPs, respectively.

- Conversely, sectors including consumer discretionary, consumer staples, healthcare, and information technology lag behind in terms of RAP adoption.

Figure 3: S&P/ASX 100 RAP breakdown by industry

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023.

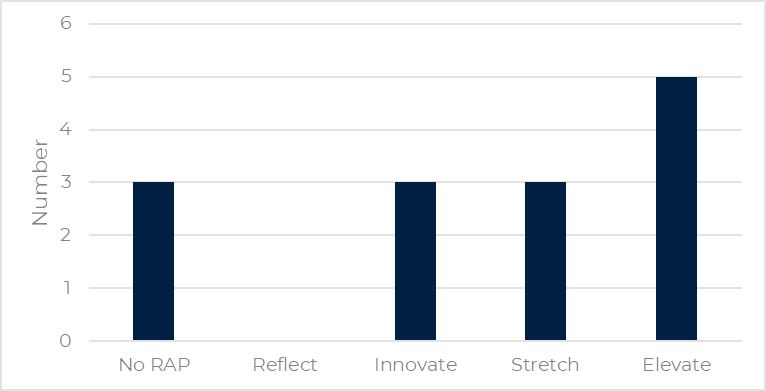

Specifically relating to the Voice referendum, it is interesting to note that 14 of the top 20 listed companies in Australia have expressed public support for the Voice. Somewhat surprisingly, of these 14 companies only 11 currently have RAPs. Less surprisingly, none of those 11 companies are at the Reflect stage and the majority are at the Elevate stage or beyond – essentially companies that are more progressed in their own reconciliation journey.

Figure 4: S&P/ASX 20 Voice Support

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023.

Incorporating Reconciliation into our ESG approach

ESG has always been a critical part of the Tyndall investment process. More recently we have added structure to the process via the development of an ESG scorecard amongst other longstanding initiatives including active ESG engagement and independent thought on ESG related matters. While social issues and diversity and inclusion performance have always been considered, we have recently updated our scorecard to specifically reflect where companies are at in their RAP journey.

Furthermore, we would highlight within the Tyndall Australian Share Wholesale portfolio around 48% of the top 100 holdings have a RAP in place and within the Income portfolio around 52% of top 100 holdings have a RAP in place.

More generally, we would note that Tyndall is a part of the Yarra Capital Management Group, and that the broader group is working with Reconciliation Australia at the earlier drafting stages of our own RAP journey.

Conclusion

Regardless of the outcome of the Voice referendum, it is clear that corporate Australia will play an increasingly significant role in progressing indigenous reconciliation efforts. This includes fostering genuine relationships, creating inclusive workplaces, and supporting initiatives that empower Aboriginal and Torres Strait Islander peoples. The pre-Voice referendum assessment of Australian corporate performance in the indigenous reconciliation journey through RAPs reveals both progress and areas for improvement.

While a notable number of companies have embraced reconciliation through the RAP framework, a significant proportion is yet to make a commitment. Encouragingly, there appears a growing understanding and acknowledgment of the need to meaningfully engage with indigenous communities.