At the same time as we are seeing global policy initiatives seeking to further accelerate the uptake of electric vehicles (EVs), corporate activity in the fuel and convenience retailing sector has stepped up. If the common belief that EVs will displace the need for Fuel Retailers, why are industry players increasing their capital allocation to the sector? We investigate the outlook for Fuel Retailers against the commonly held perception that they will ultimately be stranded assets.

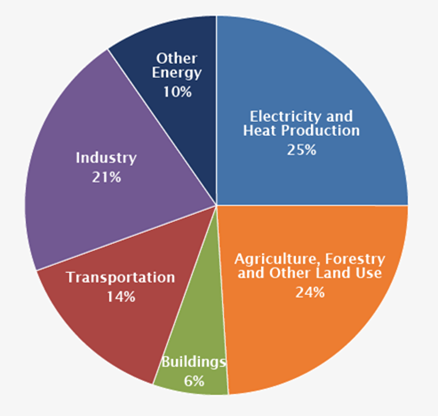

With the transport sector accounting for 14% of global carbon emissions (refer Figure 1), internal combustion engines (ICEs) are directly in the firing line of governments seeking to meet reductions targets. Further, the development of cost-competitive alternative technologies means that the transition to cleaner transport is not only achievable but now gathering significant momentum around the world.

Figure 1: Global Greenhouse Gas Emissions by Economic Sector

Source: US Environmental Protection Agency

The consequence is that ICEs are likely to go the way of the steam engine over time. This begs the question – will service stations become stranded assets? What are the prospects for these sunset industries?

Three years ago the answer to these questions was largely speculative. However, the COVID-19 period has created an ideal test environment in which the impact of a reduction in fuel volumes can be readily examined. This paper reviews the data and the risk that service stations become stranded assets.

It is beyond debate that over the next two decades the vast majority of Australia’s passenger vehicle fleet will transition to cleaner fuels. Car manufacturers are moving rapidly towards EVs, recognising the mega trend and the cost comparability. Governments around the world have varying incentives to assist in the transition, with adoption of EVs having increased rapidly as price-competitive and range issues have been overcome.

Australia lags but won’t forever

While adoption of EV’s in Australia has been relatively slow to date, it would be naïve to consider that this will remain the case.

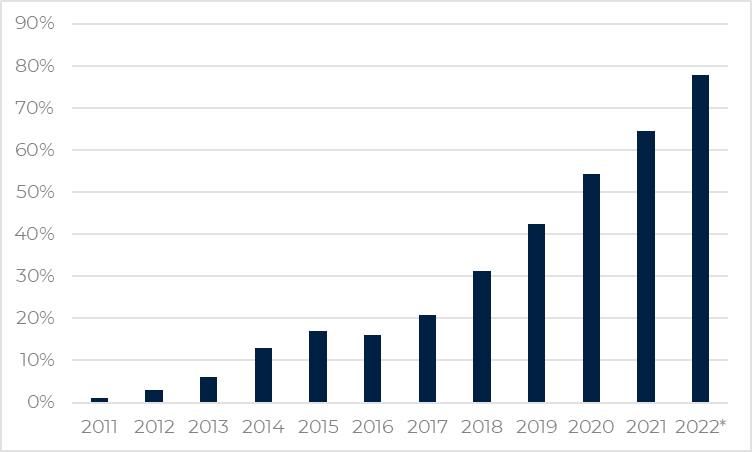

Norway is the country most advanced in electric vehicle penetration of new car sales. This has come on the back of significant government incentives for the electric vehicles and support for infrastructure development. While EVs were only 1% of new car sales in 2011, the Norwegian Office of Vehicle Statistics reports that in the nine months to September 2022, EVs represented 77.8% of new car sales (refer Figure 2).

Figure 2: Electric Vehicle Share of New Car Sales – Norway

Source: Road Traffic Information Council (OFV); Electric Vehicle Association (Elbil). *Year to date September 2022.

What would this adoption rate mean for Australian fuel volumes?

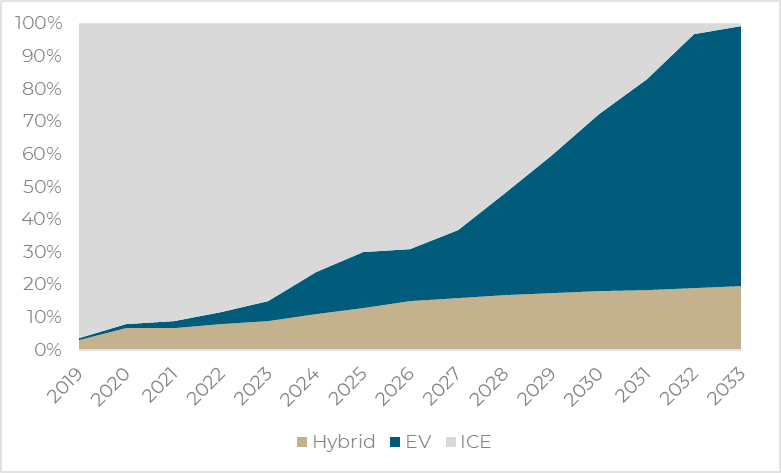

We have modelled the implications of an adoption rate as rapid as Norway’s for the Australian market, allowing us to map out the potential impact on retail fuel demand as the energy transition proceeds. We have also assumed that the uptake of hybrid vehicles accelerates from recent trend rates, as more models become available. Combined these assumptions indicate that ICE vehicles will be a rapidly declining proportion of new car sales, to the point that they are all but eliminated by 2033. Notably this is faster than the proposed legislated goal of ending ICE vehicle sales in the UK and EU by 2035 and close to the recent Biden Administration proposal to phase out ICE vehicles by 2032.

Figure 3: Composition of New Car Sales (Australia)

Source: VFACTS, Tyndall estimates

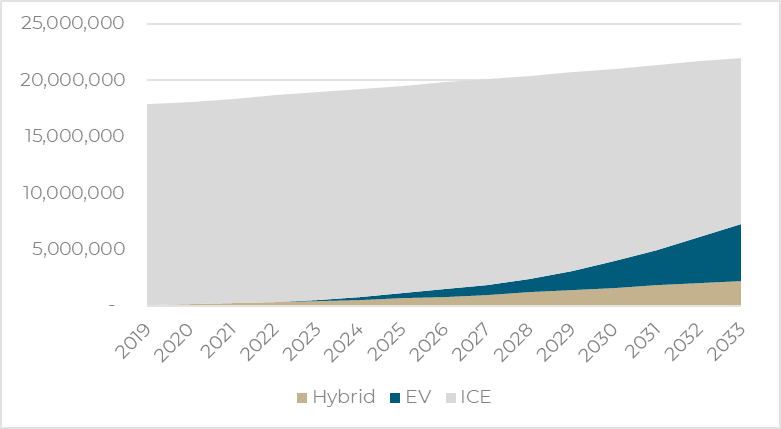

While the composition of new car sales changes rapidly in a decade, the impact on the vehicle fleet (refer Figure 4) is a much slower process. Under this scenario, hybrids and electric vehicles will represent only one-third of the total fleet by 2033.

Figure 4: Australia’s Vehicle Fleet Mix

Source: VFACTS, Tyndall estimates

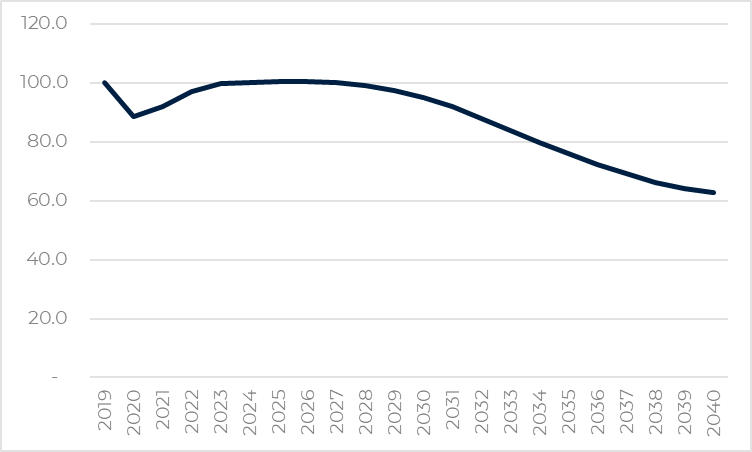

What is evident from this analysis is that the impact on volumes from the transition to electric vehicles is extraordinarily protracted (Refer Figure 5). Retail volumes are not forecast to decline from 2019 levels until 2029. And even then, the decline is only 1.3ppts. The impact does accelerate quite significantly during the following decade, with 2040 volumes forecast to be c33.5% lower than 2019 levels.

Figure 5: Fuel Volumes (Indexed to 2019)

Source: ABS, Tyndall estimates

A longer-term volume contraction is only half the story

While significant and at face value perhaps alarming, a significant decline in fuel volume is only half the story. The other relevant variable of course is price, and the COVID-19 experience has demonstrated the ability of the fuel retailing industry to maintain dollar gross margin in the face of falling volumes. This rational industry response perhaps benefited from the recent memory of unprofitable discounting that occurred during calendar 2018.

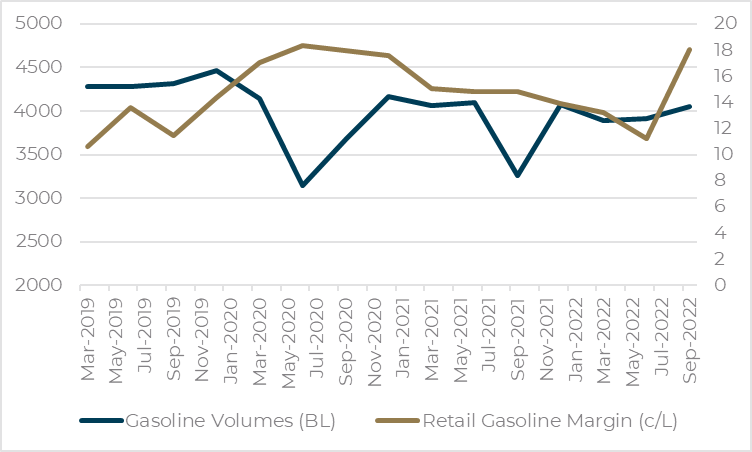

Chart 6 shows the trends in gasoline volumes and retail gasoline margins over the recent past – capturing the period of COVID disruption. As the chart shows, Fuel Retailers responded to lower volumes with price increases, such that dollar gross margins expanded.

Figure 6: Retail Gasoline Margins and Volumes

Source: Australian Petroleum Statistics, Department of Energy; Australia Institute of Petroleum; Tyndall

In the June 2020 quarter, which includes the early part of the pandemic and national lockdowns, fuel volumes fell ~45%. Retail margins in that period averaged 18.3 cents/litre, ~46% above the 2019 average.

Following the partial recovery in the ensuring quarters, over the two years to October 2022 volumes have been ~9% below 2019 levels while retail margins have been ~18% higher.

Due to the price inelasticity of fuel and a rational response in a relatively concentrated industry, retailers have been able to maintain gross profit in the face of weaker volumes.

Looking further ahead to the ~40% declines in volumes by 2040, the price increases required to offset the lower volumes are not prohibitively high. At the time of writing, retail fuel prices at $1.88/L for gasoline and $1.96/L for diesel. Retail margins for these base products were in the order of $0.20/L. Maintaining gross margin for a 40% decline that occurs over a 10-year period (plus allowing for the underlying inflation in a retailer’s cost base) would require that this retail margin increases by an average 2.7 cents/litre p.a. On the total cost of fuel this increase represents an increase of 1-2% p.a. Given the inelasticity, this is easily achievable.

Preparing for the future

As highlighted above, the medium-term outlook for Fuel Retailers is sound, with the impacts of the fleet conversion to electric vehicles a very slow burn that will not materially impact volumes for a decade. That said, the longer-term outlook does point to significant erosion of fuel volumes. While pricing offsets to combat this have been proven possible through the COVID experience and at face value are not unaffordable, the very long-term scenario is that retail fuel volumes go to zero.

In the very long term, therefore, Fuel Retailers will need to rely entirely on their shop sales. Presently the industry relies heavily on the profitability of fuel to underpin the combined fuel and shop offering. For example, ~70% of the earnings of Viva Energy’s Convenience and Mobility business currently comes from fuel. The Fuel Retailers have been increasing their attention to non-fuel income, recognising the long-term need to replace fuel earnings. This is a work in process but the global consumer trend in favour of convenience is a strong tailwind to harness.

At Tyndall we are watching this area closely and observing how the listed participants are progressing their strategies. Both Viva Energy and Ampol have de-risked their businesses by selling service station properties but with long-term options that provide ongoing control over the site.

Ampol has extended its relationship with Woolworths with the Metro offering, which is suitable for some of its network. In sites not well-suited to the Metro offering, the company has progressed its own “Foodary” brand, which has a “food on the go” style of offering.

Viva Energy is also refreshing its strategy. The acquisition of Coles Express accelerates its opportunity to progress a more contemporary and potentially more lucrative strategy. The recent acquisition of the “On the Run” network now adds a high performing offering and a scalable delivery platform. Alongside Viva Energy’s complete control of its national network, we see this combination of offering platform and network as compelling. We will continue monitoring the execution of the rollout with great interest.