There are a number of unique characteristics that make the insurance sector attractive in the current environment, including some company-specific factors which have led to valuation-based investment opportunities.

Valuing the insurance sector

Valuing insurance companies remains difficult due to the potential mismatch of estimated claims verses actual claims paid which may take years to finalise. Large catastrophes can take several years to be resolved—such as the New Zealand earthquakes—and injury claims can be stuck in the legal process for a long time. As a result, errors in claim loss forecasts can impact a company over many years.

As investors, we look at a combined ratio calculation to measure the profitability of insurance companies, which is the sum of operating expenses and claim losses divided by premium revenue. A ratio below 100% indicates profitable insurance underwriting.

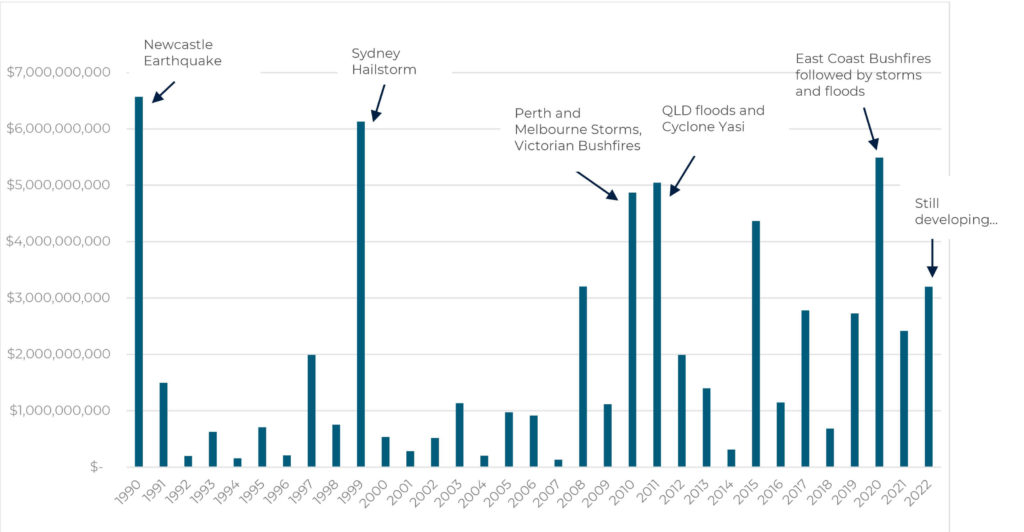

Chart 1. below illustrates the 22-year history of natural disasters in constant dollar terms. The frequency of catastrophes has been higher over the last 10 years than the prior 10 years, yet the subsequent constant currency losses have yet to eclipse the 1990 insured losses from the Newcastle Earthquake.

Chart 1. Insured losses by Financial Years (in constant $2017)

The chart is a reminder that disasters happen, and that risk is why people buy insurance to protect them from the impact of a disaster.

A well-run insurance company prices risk appropriately. Insurance companies have accepted that there is an impact on the size and frequency of claims as a result of climate change, and premiums have increased to reflect this.

Insurance companies that manage aggregate underwriting exposures through price, category limits and by selectively purchasing reinsurance (insurance for insurers) will do well over time.

What makes insurance companies attractive in the current market climate?

The current market environment is characterised by rising interest rates, energy price spikes and higher inflation. This has led to a softening in economic growth and growing fears of recession. Stagflation or recession will negatively impact profit margins and valuations for companies.

One of the things that makes the insurance sector unique is that premiums are billed and collected up-front, delivering in a premium float before claims are paid. The float is usually large and is invested to generate additional returns on top of an underwriting margin.

Typically, this large premium float is invested in a mixture of cash and bonds, and possibly a small proportion in shares and other assets. Insurance companies aim to make an insurance margin which includes a return on the float that is akin to a leveraged investment return, since the return is earned on the premium float.

The insurance sector is one of a handful that benefits from higher interest rates, with a 1% increase in rates equating to 10-20% earnings upside. The insurance Industry structure in Australia is attractive, operating as a functional oligopoly with the two major domestic insurers—QBE and IAG—taking approximately 70% market share.

What makes the structure of insurance companies different?

The business service provided by insurance companies is the pricing and pooling of risk. It does not require an inventory of raw materials or finished goods, freight costs, or energy consumption.

Premiums are typically a function of asset value and rise with the insured value. The rate of return on insurance floats improves as interest rates rise, which is the opposite outcome experienced by most companies. Inflation can flow into claims costs, though insurers do generally mitigate this by adjusting premium prices upwards. Furthermore, insurers would face similar pressure and typically be less likely to compete in an inflationary environment.

Why are the insurance stocks undervalued?

The recent increase in the frequency of disasters and associated claims has weighed on investor sentiment, with concerns that estimated losses and exposure protection limits would be exceeded. To date, the measures in place have provided adequate protection.

In addition to claim frequency, a series of operating missteps have dented investor confidence. Most notably, QBE, IAG, as to a lesser extent Suncorp, were forced to raise provisions for Business Interruption claims relating to COVID-19 and to manage costs associated with insurance policy documents incorrectly referencing the Quarantine Act 1908 (rather than Biosecurity Act 2015). IAG was disproportionately impacted by this and had to raise equity. Litigation has so far favoured the insurers, which may lead to the future release of surplus provisions for claims.

Investor confidence in IAG waned further after the company suffered humiliating make-goods as a result of failing to apply group policy discounts and payroll errors. Accusations that IAG retained risk to the Greensill financial collapse proved unfounded, with the company clarifying that the business division that had this exposure had been sold and the risk transferred to the purchaser.

What are the signs that things are improving?

Consistent with IAG and Suncorp’s February results commentary concerning premium rate increases, QBE released a performance update in early May which confirmed a healthy 22% growth in constant currency gross insurance premium revenue.

QBE indicated that after the increase in risk rates and a 9% reallocation into riskier assets, the expected running yield on the investment portfolio has almost tripled to an exit rate of ~2%.

The operating missteps of IAG and QBE have rattled investor confidence. Suncorp has fared better following its focus on cost reductions and dividends, and this has been rewarded by the market through share price gains.

We expect a recovery in market valuation and dividend payments from both IAG and QBE as: (i) the cost impact of remediation fades; and (ii) the industry-wide improvements in premium pricing are earned and higher running yields on the premium float are delivered.

The valuation, dividend profile, and sensitivity to rates, inflation, and the risk of stagflation leave IAG, QBE, and Suncorp well placed to outperform. And with high dividend payouts expected to persist, the Tyndall Australian Share Income Fund remains happily overweight the sector.