While there’s no question that 2022 has been an incredibly challenging year, Brad Potter, Head of Australian Equities at Tyndall AM, provides six key themes that he expects will help shape and navigate investment decision making decisions in 2023 and beyond. He delves into the ongoing pressures of the aggressive tightening of global monetary policy, whether the reopening of China will help prevent Australia from going into recession, and how inflation will reduce as COVID supply chain issues and the Ukraine war impacts dissipate.

Strange Bedfellows – Super cycle in renewables and oil & gas

The super cycle in renewables is in full flow and, perversely, oil and natural gas will remain a beneficiary until sufficient new renewable capacity is created.

The current renewable energy solutions of solar and wind are estimated to be some 10 times more metals intensive then the fossil fuel plants they are replacing. The life cycle of the current renewable solutions are substantially less than a typical coal or nuclear power station which last 30-50 years. The critical minerals required for global decarbonisation include rare earths, lithium, cobalt, copper and nickel. The world currently does not have sufficient reserves to fulfill the net-zero aspiration. Therefore, we expect prices will remain elevated, with Australia in a pivotal position given our resources inventory to help deliver on the energy transition (refer Tyndall’s ESG Insights: The value in securing critical minerals).

Oil development is down substantially, with cashflow from the major integrated oil and gas companies spent on buybacks, natural gas and renewable projects like solar, wind and hydrogen. Shareholder activism and government pressure have contributed to oil producers reducing capex and development spend. Traditionally, there has been a tight relationship between oil prices and drilling/development. This relationship appears to be broken, and even in the short cycle unconventional prospects onshore in the USA, companies are drilling less despite the attractive economics.

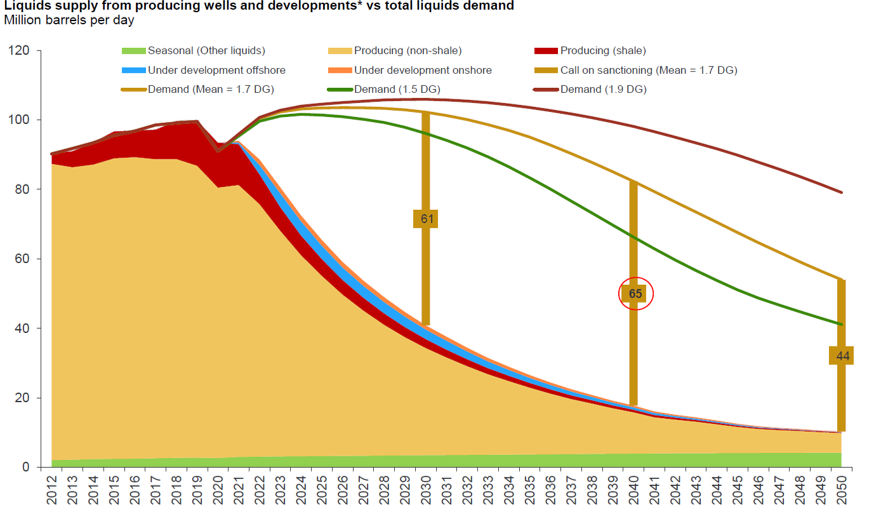

Given oil reservoir production typically depletes by 10-15% p.a., there appears to be a substantial supply gap going forward, despite demand decreasing. Norwegian oil and gas consultant – Rystad, estimate that 61m barrels of oil per day need to be developed by 2030 when using the 1.7-degree scenario (refer Figure 1).

Figure 1: Demand for oil outstrips supply

Source: Rystad

The three horseman of the apocalypse — energy, interest rates and labour cost

Increasing energy, interest rates and labour costs are substantial headwinds for many companies and as margins continue to come under pressure, we expect downgrades throughout 2023. Labour pressures are being felt in both wages and from the global impact of apparent labour shortages. Given this is felt across various sectors, it is difficult to envisage a short-term fix outside of a substantial economic downturn.

The impact of monetary policy tends to lag by 12-18 months, meaning the Australian economy is yet to feel the full impact of tightening monetary policy. Full employment and an above-average savings rates have softened the impact. The wealth impact of housing weakening further in 2023 will eventually put the brakes on consumption. The canary in the coal mine during slowdowns driven by interest rates is normally a discretionary consumer pullback. Consumer discretionary sales currently remain high with little evidence of pain felt by retailers. We expect commentary in the February 2023 reporting season may provide some early signs of both margin and top line growth pressures.

The combined impact of the materially higher cost inputs of energy, interest rates and labour should become clear over 1Q 2023. Margins are currently at high levels, and we expect pressure, particularly in companies and industries that have little pricing power to fight the inflationary forces. We see little respite in energy and labour outside of government intervention, whereas interest rates may roll over when Central Banks consider they have the inflation under control.

Be prepared for the profit downgrades.

China — exiting COVID Zero

The changes observed over the past 20 years of visiting China have been incredible given the combination of a growing middle class and high annual GDP growth. The Chinese Communist Party (CCP) is cautious to not upset the mass population. This is in contrast to an outsider’s view which tends to believe China’s people are frightened of the CCP. The catalyst for the recent COVID pivot from the CCP over COVID restrictions were the large demonstrations, often violent across China, from citizens frustrated by the restrictions. Interestingly, western governments ignored and, at times, violently pushed back on similar demonstrations. The CCP has now relented and recently announced 10 optimisation measures that mark the tipping point of the country’s economy reopening.

Therefore, in 2023 we are likely to see China go through a typical reopening phase similar to what we have observed across most western countries, resulting in consumption and GDP increasing. Australia may be a beneficiary of China reopening as consumption and demand increase. Both services and materials demand will rise, with oil and natural gas being a notable beneficiary.

Recession risk rears its ugly head

The aggressive tightening of global monetary policy aimed at slowing the economy is likely to move many countries into recession territory. It appears to be a fait accompli that Europe and the UK will dive into recession, and the debate is still ongoing on whether the USA will dip into negative GDP growth. Australia has the benefit of the world desiring its resources and agricultural products, and thus the probability of a recession appears lower, albeit in many ways this is just semantics given a slowdown is coming.

Inflation and interest rates — the return of the “old normal”

Inflation will reduce as COVID supply chain issues and the Ukraine war impacts alleviate. However, inflation will remain stubbornly higher compared to the past 10 years given obvious structural changes including labour shortages, persistent supply chain disruption and constrained supply of some goods. Technology innovation and productivity will need to accelerate to offset these pressures. Demographics, meanwhile, are negative for many countries, with a slowing population, particularly within advanced countries including China. Australia benefited prior to COVID with strong immigration but, overall, the combination of increasing demand (consumers) and decreasing supply (workers) is not great arithmetic. Global demand for labour currently is high.

We hope central bankers have learnt their lesson, given they kept monetary policy too low for too long and entered COVID with very low interest rates. It is difficult to envisage interest rates being that low outside of an emergency, meaning higher interest rates are here to stay.

The net result is that higher interest rates and inflation imply that long duration assets should further derate.

Getting deglobalisation right

Globalisation, together with China essentially selling deflation to the world over the past 20 years, will pause and perhaps even retreat. Companies and countries have recognised that relying on single supply chains or countries is risky. COVID and the Ukraine War have illustrated these risks, and we are starting to see governments develop plans to mitigate these risks.

In one example, new chip manufacturing plants are being built in the US and governments are helping to fund the critical minerals required for the pathway to net zero. Additionally, the Australian Government provided an AU$1.2b non-recourse debt facility to Iluka Resources to help fund their rare earths processing facility in West Australia. This was unprecedented for the Federal Government and illustrates how countries are viewing the access to reliable and secure supplies of critical minerals.

Most recently, the US passed the Inflation Reduction Act of 2022 (IRA), which directs nearly US$400b in federal funding to clean energy, with the goal of lowering carbon emissions by the end of the decade. There are strings attached, with many of the IRA tax incentives requiring domestic production, domestic procurement requirements or from a country with a free-trade agreement. Australia could be a beneficiary of this given our relationship with the US, which includes a Free Trade Agreement.

The bottom line is that deglobalisation is inflationary and will continue placing pressure on inflation for many years to come.

Value investing makes a big comeback

Tyndall has always viewed value investing as a philosophy rather than a factor. Our process has always aligned with the approach from Benjamin Graham, the father of value investing. Tyndall values companies based on their sustainable earnings capacity. We determine the intrinsic value by capitalising the sustainable or mid-cycle earnings of every stock under coverage. At its core, value investing is buying companies that are trading below their assessed net worth, maintaining a disciplined and patient approach.

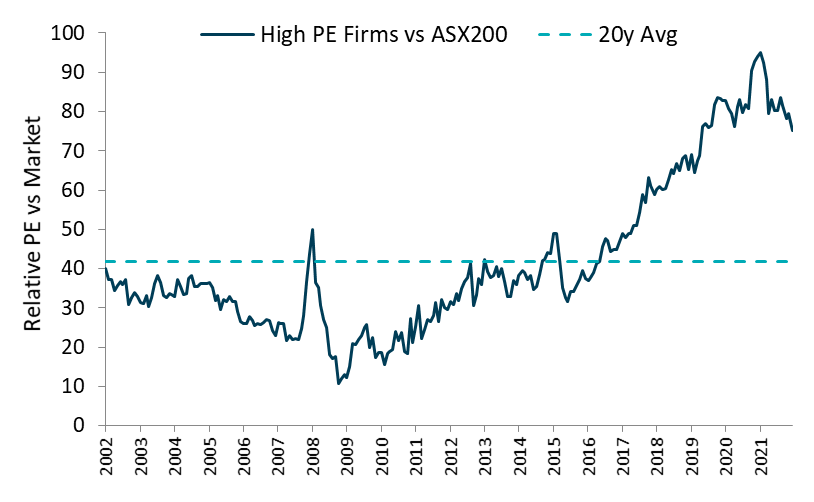

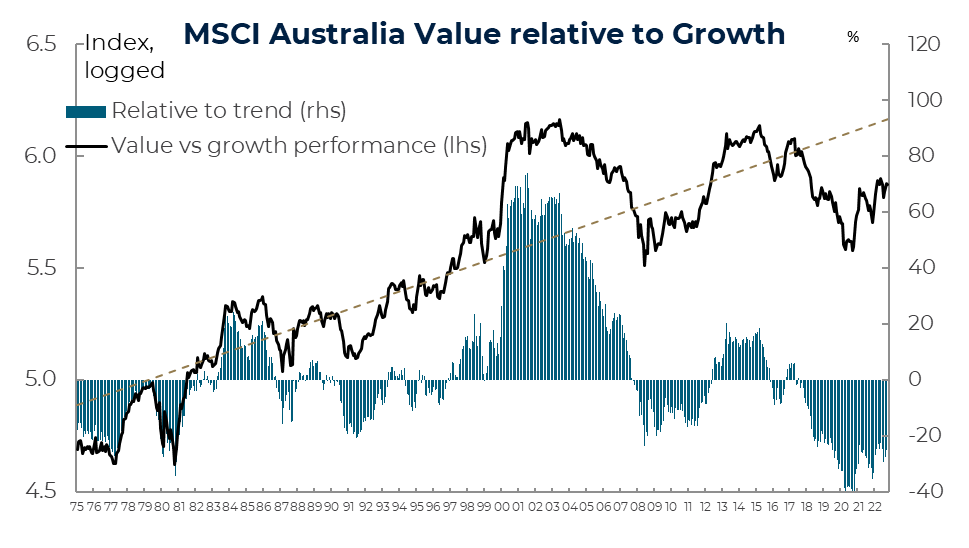

The valuation gap between growth and value remains at extraordinarily high levels despite a recent narrowing (refer Figure 2 & 3). The tailwinds for growth post the GFC are unlikely to return anytime soon. Higher inflation and interest rates are here to stay, and thus we expect the elevated valuations still being priced for growth will derate further. A disciplined and bottom-up valuation approach will deliver alpha during these times.

Figure 2: High PE firms trade at a 75% premium to the market – well above historical averages.

Source: Goldman Sachs

Figure 3: Value on track to outperform over the next few years

Source: MSCI