The Taskforce on Nature-related Financial Disclosures (TNFD) is an international initiative that is developing a framework for companies and financial institutions to disclose their nature-related risks and opportunities. Climate and net-zero commitments are well understood, with corporations relying on the Taskforce for Climate-related Financial Disclosures that released a set of recommendations in 2017.

The idea of TNFD is not entirely new. It has built upon the foundational success of the Task Force on Climate-Related Financial Disclosures (TCFD), which focuses on the financial implications of climate change for companies. However, as the global dialogue evolved, it became clear that climate was only a part of the broader environmental narrative. Biodiversity loss, land degradation, and ecosystem collapse pose significant risks to economies and businesses around the globe. The TNFD first came into existence in June 2021 to address this gap and ensure a holistic environmental approach in corporate disclosures.

Biodiversity is the diversity of all living organisms and is the living component of nature capital. Net zero and nature are intrinsically linked, and both need to be addressed to build a better and more sustainable future. A simple example of this is that forests, which cover about 31% of the earth, absorbed 7.6 gigatonnes of CO2 p.a. over the period of 2001-2019 according to a 2021 study in the journal Nature Climate Change. Preserving – and perhaps increasing – forests are key to preserving biodiversity, helping to lower ambient temperatures of regions and sequester CO2.

Importance of a nature-positive economy

A ‘nature-positive economy’ is essential for a sustainable future and is a key concept that drives the TNFD framework. A nature-positive economy is an economy that has a net positive impact on nature, an economy that restores and regenerates nature rather than depleting it. Nature provides us with essential ecosystem services, such as clean air and water, food, and climate regulation. Without a healthy natural environment, our economy and society cannot thrive.

There are several things that can be done to create a nature-positive economy. One important step is to reduce our impact on nature. This can be done by reducing our consumption of natural resources, reducing pollution, and protecting and restoring ecosystems. Investing in nature-based solutions will be an important step forward. Nature-based solutions are ways to address climate change and other environmental challenges using nature. For example, forests can be used to absorb carbon dioxide from the atmosphere, and wetlands can be used to filter water and reduce flooding.

The transition to a nature-positive economy is essential for a sustainable future. However, it is a transition that will require a concerted effort from all stakeholders, including governments, businesses, and individuals.

The sectors that have the most impact on biodiversity are the logical companies that will be the early adopters of the TNFD recommendations. These sectors include materials, energy, agriculture and food & beverage.

A framework for nature-based solutions

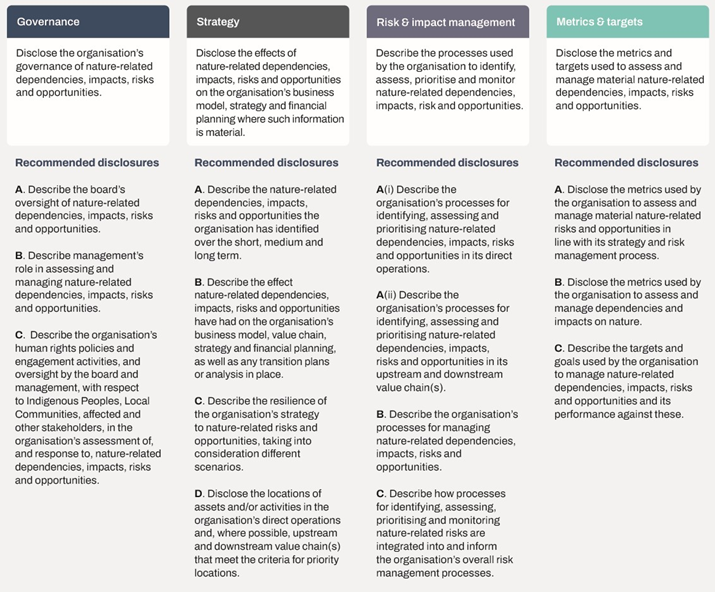

The TNFD’s final framework was published in mid-September 2023. It includes 14 recommended disclosures covering nature-related issues, impacts, risks and opportunities that are structured around four pillars (refer Figure 1).

Figure 1: TNFD’s recommended disclosures

Source: TNFD, Sept 2023.

It is hoped that the TNFD provides a clear, structured framework that help corporates understand the implications of biodiversity and natural capital for their activities. The framework is intended to assist corporates and financial institutions manage their nature-related risks and opportunities, and to support the transition to a nature-positive economy. While it is largely based on the TCFD framework, it also considers the specific risks and opportunities associated with nature.

The TNFD framework covers four specific areas:

- Nature-related dependencies: This includes the extent to which a company or financial institution relies on nature, such as for its raw materials, water, or pollination services.

- Nature-related impacts: This includes the positive and negative impacts that a company or financial institution has on nature, such as through its operations, supply chain, or investments.

- Nature-related risks: This includes the risks that a company or financial institution faces from nature, such as from climate change, biodiversity loss, or water scarcity.

- Nature-related opportunities: This includes the opportunities that a company or financial institution can seize from nature, such as by investing in sustainable agriculture or renewable energy.

The TNFD framework is expected to be a valuable tool for companies and financial institutions to manage nature-related risks and opportunities. It will also help to promote the transition to a nature-positive economy.

Some of the benefits of the TNFD framework include:

- Helping companies and financial institutions to identify and manage their nature-related risks and opportunities.

- Improving the transparency of nature-related risks and opportunities.

- Driving investment in nature-positive activities.

- Aligning financial markets with the targets of the Paris Agreement and the UN Sustainable Development Goals.

Global progress

Although the TNFD framework has only recently been settled; governments and intergovernmental organisations have increasingly called attention to the impact on nature. Pleasingly, a rising number of businesses have made pledges relating to biodiversity.

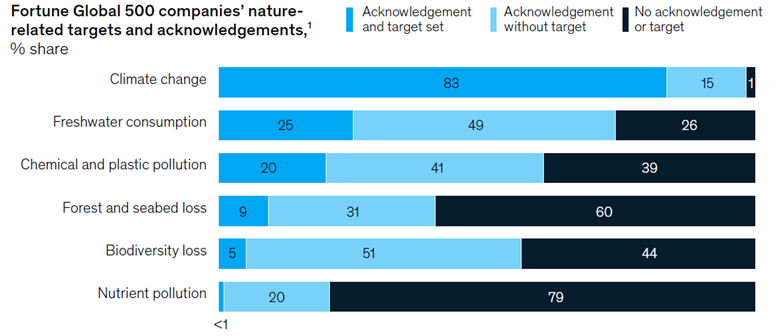

Companies globally are only in the early stages of setting a broad set of nature-related goals whereas most have set climate-related targets (refer Fig 2). The EU set a biodiversity strategy in 2020 that aims to complete 100 target actions by 2030. Some of these targets include restoring degraded and carbon rich ecosystems, converting at least 30% of its land and ocean area into legally protected areas and encouraging at least EUR20bn p.a. in bio-diversity-related financing. Despite this, S&P claims that only 29.5% of the largest companies in the S&P Europe 350 Index have set biodiversity targets

Figure 2: Corporate targets are less common for other dimensions of nature compares to climate change

Source: McKinsey

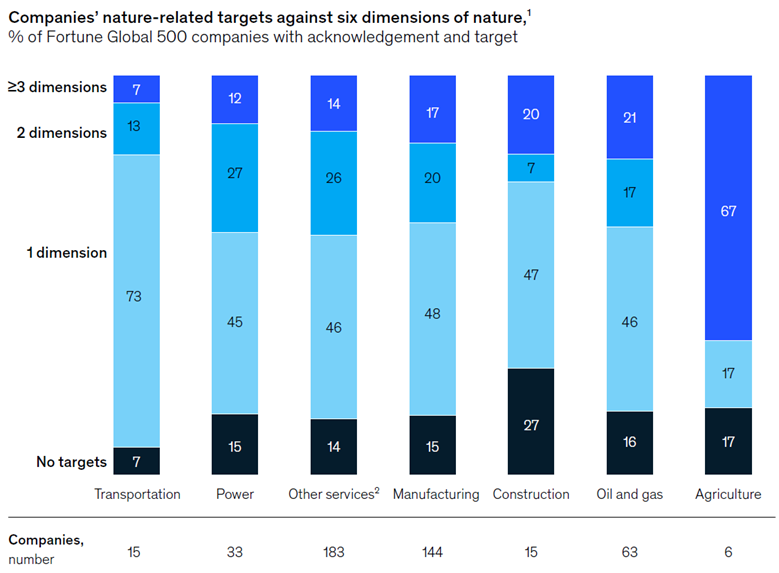

McKinsey has calculated that ~47% of Fortune Global 500 companies have set nature-related targets against one dimension of nature – generally this is against climate (refer Figure 2). Approximately 16% have set targets against three or more dimensions of nature and no companies have targets against all six dimensions that were looked at in this analysis. The Science-Based Targets for Nature (SBTN) initiative suggests that companies are more likely to focus on the key issues that directly impact their activities which could explain why no company has set targets against all six dimensions. Cutting the data based on a sector level reveals that the sectors that have a higher exposure to biodiversity risk are leading the charge on target setting.

Figure 3: Fortune Global 500 Companies’ nature-related targets by sector

Source: McKinsey

Implementation of TNFD

Implementing TNFD is not without its challenges. In particular, there’s a need for:

- Data Collection: Many companies lack the data or the means to gather it to understand their complete environmental impact;

- Standardization: With no globally recognized metrics to measure nature-related risks, creating a standardized framework will be demanding;

- Economic Pressures: Short-term profit goals can overshadow long-term sustainability targets, making it challenging for some companies to prioritize nature-related disclosures; and

- Stakeholder Alignment: All stakeholders, from suppliers and employees to regulators and consumers, need to align for effective disclosure and action.

The framework is consistent with the recommended standards of the TCFD, ISSB (International Sustainability Standards Board) and GRI (Global Reporting Initiative). The recommendations have an intention to provide a practical solution for corporates to start their journey to increase the scope and disclosures over the coming years. The expectation is that, as with climate-related reporting, TNFD disclosures will improve over time.

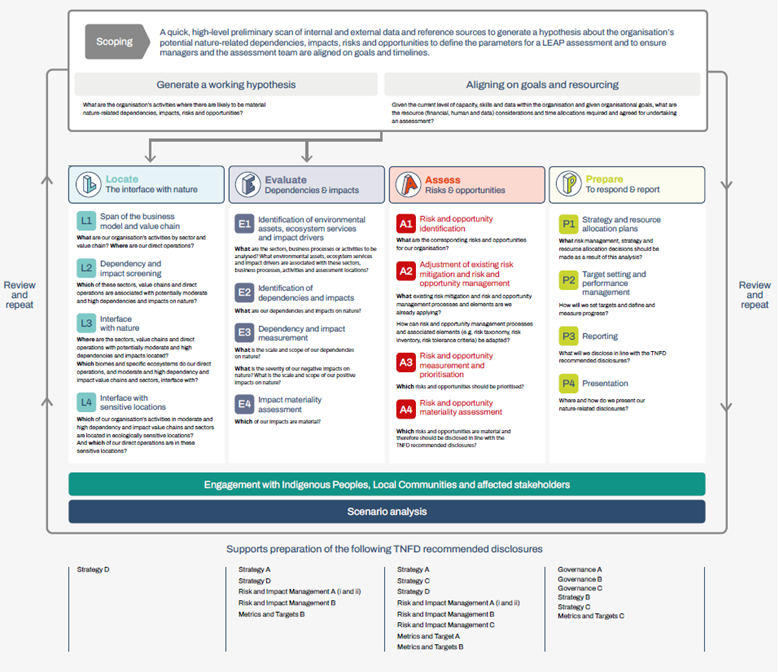

The LEAP approach – Locate, Evaluate, Assess and Prepare – has been developed by the TNFD to help organisations to identify, assess and manage nature-related risks and opportunities. While the approach is not a requirement, it is designed to help with identification and assessment. Figure 4 provides an overview of LEAP and its elements, which covers:

- Locate: Identify the organization’s interface with nature, including its direct operations, supply chains, and value chains.

- Evaluate: Evaluate the organization’s dependencies and impacts on nature.

- Assess: Assess the nature-related risks and opportunities facing the organization.

- Prepare: Prepare to respond to (and report on) nature-related risks and opportunities.

Figure 4: The TNFD approach for identification and assessment of nature-related

Source: TNFD, Sept 2023

Conclusion

While the challenges are significant, the TNFD offers a critical pathway for integrating nature into financial decision-making and improving outcomes for our environment. The success of the TCFD suggests that with global cooperation and commitment, the TNFD can become an influential tool in driving sustainable business practices. Governments, financial institutions, environmental organizations, and businesses all have important roles to play.

By implementing frameworks such as the TNFD, the global community takes a step closer to ensuring that the economic activities of today do not compromise the planet’s well-being tomorrow. The shift from merely profit-driven strategies to those that also account for nature-related impacts signifies an evolution in global business practices. It is an evolution that is not just commendable but essential for the longevity and prosperity of both businesses and the planet.

Tyndall will be increasingly engaging with corporates around biodiversity and promoting the implementation of the TNFD framework, as we have been with TCFD. According to work by Jarden, only 12 (24%) of ASX50 companies have nature-related targets. It was noted that BHP, Woolworths, South 32 and Origin Energy had undertaken TNFD pilots, and only Brambles and South 32 have linked nature to remuneration.

Clearly, there is plenty of improvement required. We expect that those companies in sectors more exposed to nature-related risks such as agriculture, food and beverage, and mining, are likely to lead the charge.