2020 saw a number of firsts, including a global pandemic, a short-lived recession and an unprecedented surge in equity markets. If past recessions are anything to go by, value stocks are due for a resurgence. What factors will drive the valuation rotation and will 2021 be the year for value?

Remembering an unforgettable year

The year 2020 saw a number of firsts for many, including a global pandemic resulting in a very short-lived but deep COVID-19 recession that was exacerbated by government mandated shutdowns. Multi-sector industry stock rotations saw an initial flight to safety followed by a cyclical recovery that appears to be following textbook style patterns seen in previous recessions. The surge in equity markets in November was also unprecedented with the returns marking an all-time record.

Nikko AM has observed and commented previously that post virtually all recessions in the US, value has outperformed as we see a change in style leadership due to the recovery in the economy and earnings growth. The relationship is less convincing in Australia only because it has endured just two recessions over the past 30 years.

The prolonged period of elevated risks appears to be reducing as risks around COVID-19, global trade war, US election uncertainty—to name a few—are clearing up. We always believed that two condition precedents were required for the value rotation to take hold; namely, clearing the US election and positive news on either a vaccine or therapeutic protocols. Both occurred in the same week in early November 2020.

We now have three vaccine candidates from Pfizer, Moderna and AstraZeneca that look promising together with Chinese and Russian vaccines that are also touted as being successful.

Growth to value rotation: “The swing is in”

Value stocks in recent years have included companies exposed to the economic cycle. Such stocks have historically performed strongly coming out of recessions, as market leadership changes from defensive and growth stocks to stocks that will benefit from an improving economic outlook.

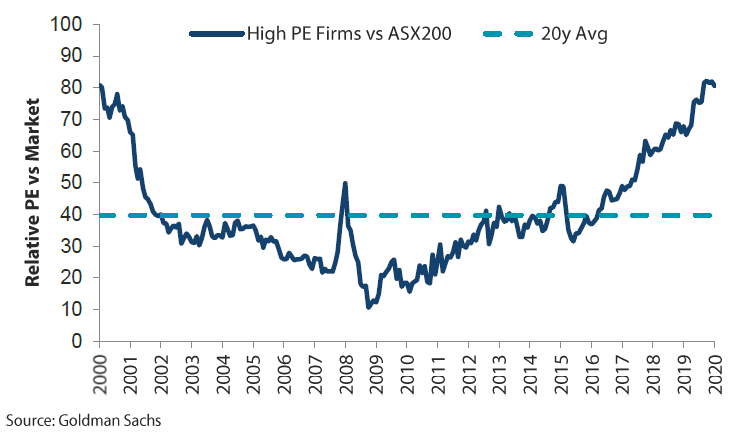

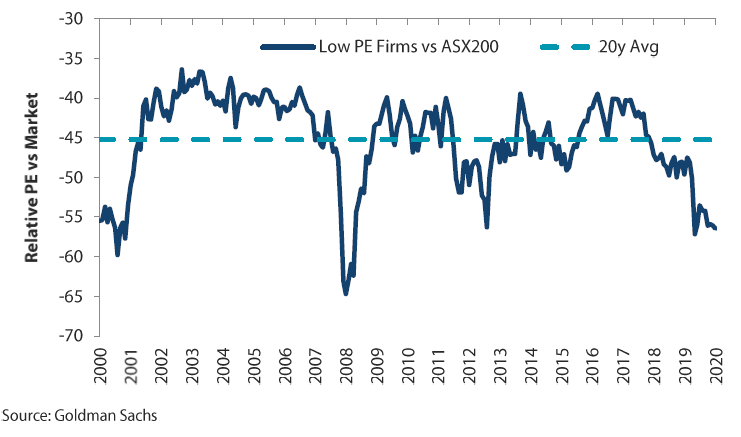

The bursting of the dot-com bubble and GFC led to a switch to value. The value drawdown that started in 2017 is one of the worst investors have witnessed and took another leg down due to COVID-19. Not only has the growth style continued to experience multiple expansions relative to the market, value stocks have seen a further de-rating from a fall in earnings expectations due to the recession. This is reflected in Charts 1 and 2, which show low PE stocks trading 10% below long-term averages but high PE stocks trading 39% above.

The PE premium for growth stocks is at or close to all-time highs, continuing the momentum that started in the middle of this decade where investors have adopted the Growth At Any Price (GAAP) mantra. Suffice to say, the forward PE for the growth style is extremely elevated on both an absolute basis and relative to value.

Chart 1 – High PE firms trade at an 81% premium to the market, which is 37% above the 20-year average

Chart 2 – Low PE firms trade at a 56% discount to the market, which is 10% below the 20-year average

How we have responded

The rapid bear market was followed by one of the quickest bull markets in history and has made fundamental value investing difficult. Government shutdowns followed by ‘helicopter money’ from governments and central banks has been an enormous contributor to this rebound.

Unusual opportunities arose during the shutdowns as typically defensive and safe companies found their businesses essentially shut. Nikko AM thus entered into attractive new positions in Transurban and Coca-Cola Amatil, which we have not owned for many years given lofty valuations. However, based on our long-term mid-cycle sustainable earnings process, they became cheap.

Looking through the lockdowns, it was obvious that Transurban’s roads would be used again and Coca-Cola would again be sold through the high margin route trade market as cafes, restaurants and delicatessens reopened. Crown Resorts, another company that we have not invested in for years, became cheap due to a combination of the Victorian shutdown and the recent regulatory review.

ESG—particularly governance—has always been an issue for us in regards to Crown. However, the review has acted as a catalyst to clean up the business and governance, and we believe Crown will come out of it in great shape. ESG issues that can be solved provide great entry points for a patient value investor.

We continue to take profits in a number of winners and have rotated them into more attractively valued stocks. We have gradually been building our position in the cheap banks given the tail risk around the credit cycle appears to have reduced due to deferred loans in both mortgages and SMEs reducing substantially. The banks appear to be well provisioned and we expect increased profits and dividends going forward over the next few years.

M&A is likely to be part of the recovery process given the low interest rate environment, and cash position of private equity and corporates. The earnings yield to debt yield gap remains wide and thus corporates can buy earnings growth very cheaply with debt.

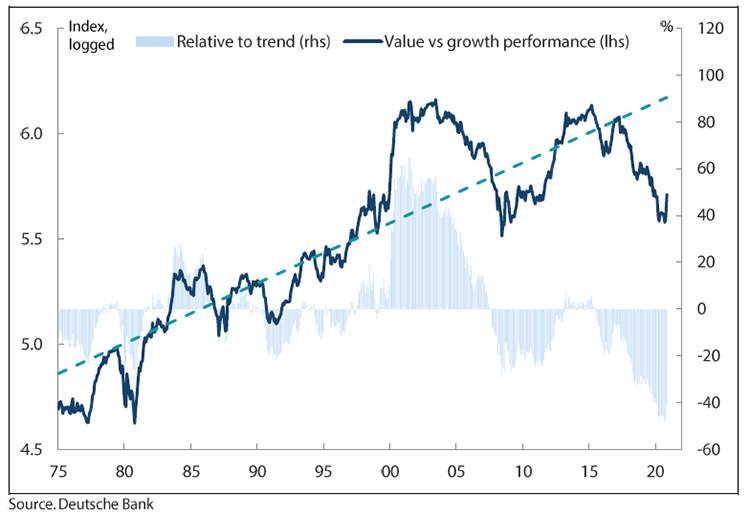

Despite the recent rotation and thus sharp rally in value, it has still materially underperformed growth over the past 12 months and has a long way to reverse the recent under performance (refer to Chart 3).

Value typically outperforms for at least 12 months after a major trough in earnings. What makes this rotation even more fascinating is the combination of the enormous dispersion in value together with the huge skew in positioning.

Chart 3 – MSCI Australian value relative to growth

Conclusion

As a value manager, our conviction lies in a process that is based on long-term sustainable earnings and cash flows, priced on appropriate multiples. So, when the market reverts to more normal conditions, a patient active value manager (and investor) can benefit enormously.

The global business cycle continues to surprise on the upside with strong Purchasing Manager’s Index (PMI) and Institute of Supply Management (ISM) data helped by the unprecedented and quick government interventions. With vaccines on the horizon, economies are likely to start the long road of recovery out of the pandemic-induced economic shock.

Interest rates have essentially been anchored by central bank intervention globally while inflation expectations are showing a recovery from low levels. This setup has historically been positive for value as bond yields trickle up, resulting in a steepening of the yield curve.

The tough decade for value investors has created attractive investment opportunities that a well-disciplined value investor can harness. Our process is well positioned to take advantage of the opportunity set that requires a long-term investment horizon that looks through the current uncertainty, and a detailed bottom-up focus that identifies attractively priced companies that we believe are positioned to be rewarded in the economic recovery.

Important Information

This material was prepared and is issued by Nikko AM Limited ABN 99 003 376 252 AFSL No: 237563 (Nikko AM Australia). Nikko AM Australia is part of the Nikko AM Group. The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided.