BHP Group Limited (BHP), a global mining giant, has reaffirmed its commitment to sustainability through an in-depth decarbonisation strategy, which was showcased during an investor presentation on 26 June 2024. The company is making significant strides toward achieving its ambitious medium- and long-term decarbonisation goals, focusing on substantial reductions in greenhouse gas (GHG) emissions across its operations and value chain. This insight delves into BHP’s progress, key initiatives, and future plans for decarbonisation.

Operational Emissions Reduction: Progress and Goals

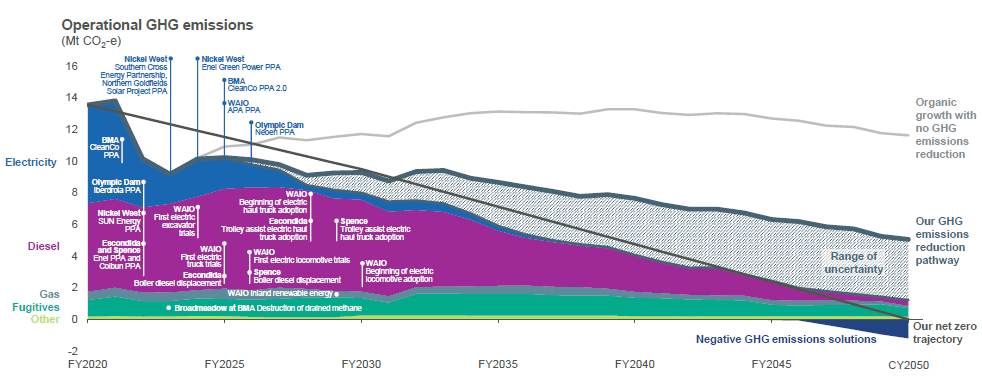

BHP is on track to meet its target of reducing scope 1 and 2 emissions by 30% by FY2030, compared to FY2020 levels. By FY2023, the company had already achieved a 32% reduction, predominantly through investments in long term renewable energy power purchase agreements, underscoring its commitment to a sustainable future. To maintain this level of performance as the company – and its emissions – continues to grow is a substantial investment of approximately US$4 billion in decarbonisation initiatives up to FY2030.

Key Initiatives:

- Renewable Power Purchase Agreements (PPAs): BHP has implemented PPAs across multiple assets, aiming for a 50% reduction in scope 2 emissions by FY2025. These agreements are crucial in shifting the company’s energy mix toward renewable sources.

- Diesel and Natural Gas Reduction: With diesel accounting for 62% of operational emissions, BHP is prioritising its displacement through electrification projects. Biofuels serve as a backup option if delays occur.

- Electrification Projects: The company is focusing on adopting trolley assist electric haul trucks in Chile, with plans to deploy electric trucks and rail in Australia by 2028 and 2029, respectively. These efforts are essential to reducing reliance on fossil fuels and significantly cutting operational emissions.

Figure 1: BHP’s operational decarbonisation trajectory

Source: BHP, June 2024

A key learning from this year’s decarbonisation roundtable is that the pathway to decarbonisation is non-linear and requires significant effort to overcome technological challenges and organic growth. For example, while a material displacement of diesel use is not required to meet the 2030 target, it is critical for achieving the 2050 net zero goal. This involves transitioning BHP’s haul trucks to an electric fleet, which we learned has experienced a ~12-month delay in the Komatsu electric truck trial (now expected in 2026) and electric rail trials (now expected in 2025).

Tackling Scope 3 Emissions: Innovations in Steelmaking and Shipping

BHP is addressing scope 3 emissions, focusing on reducing the carbon footprint of steelmaking and shipping, which are critical areas for the company. The goal is to achieve a 30% reduction in emissions intensity in steelmaking by 2030 and a 40% reduction in shipping emissions intensity by the same year, with a long-term target of net zero by 2050.

Steelmaking:

- Technology Development: BHP is involved in numerous projects that focus on raw material preparation, including Carbon Capture, Utilization, and Storage (CCUS) trials, and improvements for blast furnaces (BF), Direct Reduced Iron (DRI), and Electric Smelting Furnaces (ESF)/Electric Arc Furnaces (EAF). These technologies are pivotal in reducing the emissions intensity of steel production.

- Collaborations: The company is advancing readiness for an electric smelting pilot facility, in partnership with Rio Tinto and BlueScope Steel, targeting commissioning by 2027. This facility is expected to play a crucial role in demonstrating and scaling low-emission steelmaking technologies.

Shipping:

- Emission Intensity Reduction: BHP has already achieved a 41% reduction in GHG emissions intensity for BHP-chartered shipping against a 2008 baseline. The company aims to reach a 40% reduction by 2030, demonstrating its leadership in maritime decarbonisation.

- Innovative Trials: BHP is trailing wind-assisted propulsion and hull coatings to enhance efficiency and reduce fuel consumption. Additionally, the company has successfully conducted trials with sustainability-certified biofuels, which are now operational for select voyages.

- Future Fuels: BHP is exploring the use of ammonia as a low-emission fuel and has launched an expression of interest to establish an ammonia value chain by 2030. Ammonia is seen as a promising alternative that can significantly reduce shipping emissions. This will be welcomed news in Japan where an ammonia fuel industry is being established. We expect the Japanese government to finalise its ammonia strategy and launch legislative processes for specific subsidy programs by the end of the year.

Methane Emissions: A Critical Focus

Addressing methane emissions from coal operations is another significant aspect of BHP’s decarbonisation strategy. The company employs industry best practices for measuring and reducing fugitive emissions at its open-cut mines. At the Broadmeadow underground steelmaking coal mine, drainage methane is captured and flared, reducing its impact on the environment. Methane has a global warming potential (GWP) approximately 84-86 times that of CO₂ over a 20-year period and about 28-36 times over a 100-year period.

Future outlook

Strategic Collaborations:

- Equipment Manufacturers: BHP is collaborating with major equipment manufacturers to accelerate the development of the required technologies. These partnerships are essential for driving innovation and achieving the company’s decarbonisation targets.

- Steelmakers: BHP has nine partnerships with steelmakers, representing approximately 20% of global steel production. These collaborations are aimed at developing and scaling near-zero emissions technologies for the steel industry.

BHP Group’s proactive and detailed decarbonisation strategy is testament to its commitment to sustainability and environmental responsibility. As the company continues to implement its initiatives and progress toward its ambitious targets, it sets a strong precedent for the industry. BHP’s efforts not only support global climate goals but also drive the transition towards a more sustainable future.

Tyndall’s current overweight position is predicated on attractive valuation metrics and the company’s proactive approach to environmental stewardship, social responsibility, and robust governance. These principles not only enhance its operational resilience and reputation but also align with global efforts to address climate change and promote sustainable development.