Reviewing the recent US Department of Energy’s “Pathways to Commercial Liftoff: Advance Nuclear” is a refreshing analysis of nuclear as an essential component to the energy transition puzzle. Since the original publication of this report in 2023, U.S. power demand projections have increased significantly. Much of the growth stems from the expansion of industries with round-the-clock energy needs, such as data centres powered by artificial intelligence (AI), high-performance computing, and industrial electrification. Grid planners have updated demand forecasts, projecting a doubling of electricity needs by 2050. According to the North American Electric Reliability Corporation (NERC), the nationwide growth forecast for electricity demand more than doubled from the previous year, with projections for 560 GWh of growth over the next decade.

As the energy sector expands, decarbonisation goals become more challenging to achieve with renewable energy alone due to its intermittent nature. Nuclear power, which provides consistent, firm capacity, can fill this gap. Firm power refers to electricity that is available 24/7, ensuring reliability under all grid conditions. The Department of Energy (DOE) report emphasizes that both renewable energy and nuclear power are essential for cost-effective decarbonisation. Relying solely on renewables and battery storage results in higher overall system costs due to the need for overbuilding renewable capacity and storage to meet peak demand. Nuclear, by contrast, offers firm power that reduces the need for excess variable generation and large-scale energy storage, thus lowering system costs.

The path to triple capacity

To meet decarbonisation targets, the U.S. must significantly increase its nuclear capacity. In 2024, the country had around 100 GW of installed nuclear capacity, providing 20% of U.S. electricity generation and almost half of its carbon-free power. The DOE projects that this capacity must triple to approximately 300 GW by 2050 to maintain energy reliability and meet clean energy goals. Multiple models of system decarbonisation indicate that tripling nuclear capacity is necessary to achieve net-zero emissions. These models take into account limitations in renewable energy deployment, such as transmission constraints and land use challenges.

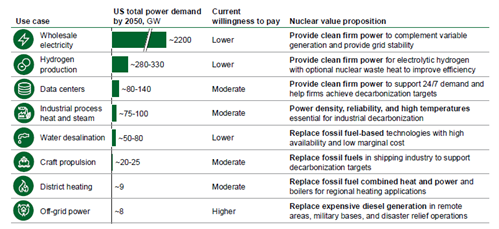

Figure 1: Nuclear has wide usage beyond wholesale electricity production

Source: DOE, 2024

Nuclear Technologies: Gen III+, Gen IV, and their applications

Advanced nuclear energy technology can be broken down into two primary generations—Generation III+ and Generation IV reactors—categorized by size into large, small, and microreactors.

Generation III+ Reactors

Generation III+ reactors are an evolutionary step forward from the traditional light water reactors (LWRs) that make up the majority of the current U.S. nuclear fleet. These reactors use water as a coolant and low-enriched uranium (LEU) as fuel, similar to existing nuclear technologies, but incorporate enhanced safety features. Passive safety systems, for example, can shut down reactors automatically without operator intervention in the case of an emergency, significantly reducing risk. These reactors have lower construction and operational costs and are likely to lead the near-term growth in nuclear capacity, given their similarities to current reactor designs.

Generation IV Reactors

Generation IV reactors represent the next wave of innovation in nuclear technology. These reactors will use advanced coolants – such as gas, liquid metals, or molten salts – and more highly enriched fuels, such as high-assay low-enriched uranium (HALEU). These reactors offer several advantages, including higher operating temperatures that allow for greater efficiency and diverse use cases such as industrial heat production, which is critical for sectors like steelmaking and chemicals.

Gen IV reactors are still in the development and demonstration phase and will require significant investment and regulatory support before they can be deployed at scale. However, they hold significant potential to complement Gen III+ reactors in providing diverse energy solutions across different industrial sectors.

Size Categories: Large, Small, and Microreactors

The DOE report identifies three size categories for nuclear reactors, each serving distinct market needs:

- Large reactors (~1000 MW): Primarily Gen III+ LWRs, these reactors will remain critical for bulk electricity generation in large power grids. Their economies of scale make them cost-effective for regions with high energy demand.

- Small modular reactors (SMRs, ~50-350 MW): SMRs offer greater flexibility and are better suited for replacing smaller, retiring fossil fuel plants or serving industrial processes that require high-temperature heat. While SMRs may have higher capital costs per MW, their flexibility in siting and quicker construction timelines make them an attractive option for certain applications.

- Microreactors (<50 MW): Microreactors have specific advantages for remote applications, military bases, and regions with limited access to energy infrastructure. Their compact size and transportability make them ideal for remote communities, off-grid mining operations, and disaster relief efforts.

Value Proposition of Nuclear Power

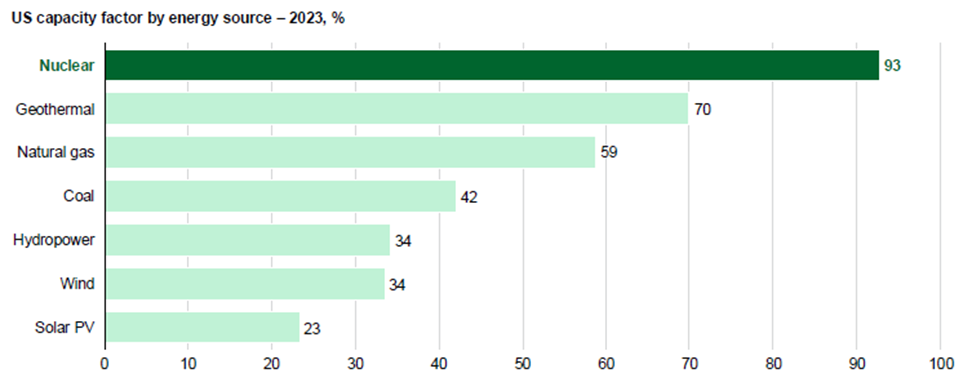

Clean and reliable firm power

One of the key value propositions of nuclear energy is its ability to generate clean, carbon-free electricity while providing firm power. Unlike renewables, which are intermittent, nuclear power provides consistent energy output, ensuring grid stability and reliability. By offering reliable power with low carbon emissions, nuclear can complement renewables, helping to meet net-zero goals while maintaining grid stability. Nuclear energy also benefits from low land-use requirements, which is particularly advantageous in regions where land is scarce or expensive.

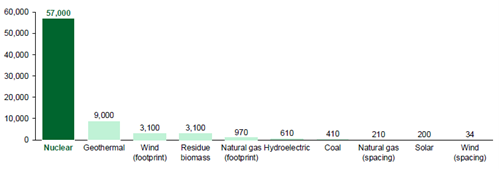

Figure 2: Nuclear has the highest capacity factor of any energy source

Source: DOE, 2024

Economic benefits

Nuclear power also offers significant economic benefits, both in terms of job creation and economic output. Nuclear plants create high-paying jobs and support local economies. According to the DOE report, nuclear power plants employ three-times more workers per GW than wind power plants and provide wages that are ~50% higher. Furthermore, many existing nuclear sites are located in areas that previously housed fossil fuel plants, making them ideal for future nuclear expansion and ensuring that local communities retain access to high-quality jobs.

In addition to local job creation, nuclear energy has lower transmission requirements than distributed energy sources, as plants can be situated closer to demand centers. This reduces the need for new transmission infrastructure, which can be costly and time-consuming to build, thus offering a further economic advantage.

Challenges and solutions for nuclear liftoff

Despite its advantages, nuclear energy faces several barriers to commercial liftoff. The DOE report identifies key challenges and potential solutions for overcoming them.

Historical nuclear projects, such as the Vogtle Units 3 and 4, have faced significant cost overruns and delays. These setbacks are largely attributed to incomplete designs, immature supply chains, and a lack of workforce training. To address these issues, the DOE emphasizes the importance of comprehensive pre-construction planning, standardized designs, and robust project management. Vogtle, for instance, began construction with an incomplete design and an untrained workforce, leading to delays. Lessons from Vogtle underscore the need for more mature supply chains and better-trained workforces in future projects. Standardizing reactor designs, improving workforce training, and avoiding customization will be essential to reducing construction times and costs.

One of the key barriers to expanding nuclear capacity is the lack of a sufficiently skilled workforce. The U.S. nuclear workforce currently stands at around 100,000 workers, but to meet the goal of tripling nuclear capacity by 2050, the workforce will need to grow by an estimated 375,000. This expansion will require significant investments in education and training, particularly in specialized areas such as welding, nuclear engineering, and operations. Developing partnerships between the government, educational institutions, and private industry is critical for closing this skills gap.

- Cost and Schedule Overruns

Historical nuclear projects, such as the Vogtle Units 3 and 4, have faced significant cost overruns and delays. These setbacks are largely attributed to incomplete designs, immature supply chains, and a lack of workforce training. To address these issues, the DOE emphasizes the importance of comprehensive pre-construction planning, standardized designs, and robust project management. Vogtle, for instance, began construction with an incomplete design and an untrained workforce, leading to delays. Lessons from Vogtle underscore the need for more mature supply chains and better-trained workforces in future projects. Standardizing reactor designs, improving workforce training, and avoiding customization will be essential to reducing construction times and costs.

- Workforce development

One of the key barriers to expanding nuclear capacity is the lack of a sufficiently skilled workforce. The U.S. nuclear workforce currently stands at around 100,000 workers, but to meet the goal of tripling nuclear capacity by 2050, the workforce will need to grow by an estimated 375,000. This expansion will require significant investments in education and training, particularly in specialized areas such as welding, nuclear engineering, and operations. Developing partnerships between the government, educational institutions, and private industry is critical for closing this skills gap.

- Supply chain limitations

The U.S. currently lacks sufficient manufacturing capacity for key nuclear components, such as reactor pressure vessels. Scaling up nuclear energy will require expanding the supply chain to meet the demand for both large and small nuclear reactors. In particular, there are significant gaps in the domestic supply of nuclear fuel, especially HALEU which is essential for Gen IV reactors. Developing a robust domestic supply chain for nuclear fuel and components will be essential to avoiding project delays and cost overruns.

- Financing and risk sharing

Financing nuclear projects remains a significant challenge due to the high upfront costs and long construction times. The DOE recommends consortium approaches, in which multiple stakeholders share the financial risks associated with new nuclear projects. Such models can help distribute the cost burden across different actors, reducing the financial exposure of any single entity. Additionally, the Inflation Reduction Act (IRA) provides several tax incentives, including production tax credits (PTCs) and investment tax credits (ITCs), which can reduce the capital costs of new nuclear projects by up to 50%.

US Government support for nuclear expansion

Inflation Reduction Act (IRA)

The IRA plays a critical role in supporting nuclear energy development by offering tax incentives for both existing and new reactors. Existing reactors can benefit from production tax credits, while new reactors are eligible for either a PTC or an investment tax credit (ITC) of 30%, which can increase to 50% with certain eligibility criteria. These credits significantly reduce the capital costs associated with nuclear construction, making it easier for utilities to commit to new projects.

Loan Programs Office (LPO)

The DOE’s Loan Programs Office (LPO) has expanded its authority to provide loan guarantees for up to 80% of project costs for nuclear construction. This offers a critical de-risking mechanism for first-of-a-kind (FOAK) nuclear projects, which are often more expensive due to the learning curve associated with deploying new technologies. LPO loans can make nuclear projects more attractive to private investors by reducing the financial risk.

Regulatory Reforms and Licensing Efficiency

The DOE report emphasizes the need for regulatory reforms to streamline the licensing process for new nuclear reactors. Congress has passed the ADVANCE Act, which aims to increase the efficiency of nuclear licensing and reduce the regulatory burden on new projects. Simplifying the regulatory process will be essential for accelerating nuclear deployment, particularly for Gen IV reactors which face additional regulatory challenges due to their innovative designs.

Industrialisation and supply chain growth

To meet the goal of tripling nuclear capacity by 2050, the U.S. nuclear industry will need to scale up significantly. This industrialization process involves expanding the workforce, building out the supply chain, and developing key manufacturing capabilities.

Workforce expansion

Expanding the nuclear workforce is critical to achieving liftoff. In addition to specialized training programs for nuclear operators, engineers, and technicians, the DOE recommends creating apprenticeship programs to train the next generation of nuclear workers. These programs should target underrepresented communities to ensure that the benefits of nuclear expansion are distributed equitably across the U.S. The DOE report highlights the importance of working with trade unions and educational institutions to develop these programs.

Fuel Supply Chain

One of the key challenges in expanding nuclear energy is ensuring a stable supply of nuclear fuel, particularly HALEU. Currently, the U.S. lacks sufficient domestic capacity to produce HALEU, and much of the supply comes from foreign sources. To address this, Congress has allocated $2.72 billion to incentivize the development of a domestic HALEU supply chain. This investment will support the construction of new enrichment and fuel fabrication facilities, ensuring that U.S. nuclear reactors have access to a reliable fuel supply.

Component Manufacturing

The nuclear industry will also need to expand its capacity to manufacture key components, such as reactor pressure vessels and steam generators. These components are often bottlenecks in nuclear construction projects, as few companies worldwide have the capability to produce them at scale. The DOE recommends incentivizing domestic manufacturing of these components to reduce dependence on foreign suppliers and avoid delays in future projects.

Environmental and social benefits of nuclear expansion

In addition to its role in decarbonisation, nuclear energy offers several environmental and social benefits that make it an attractive option for future energy development.

Low carbon emission

Nuclear energy has one of the lowest life-cycle carbon emissions of any power generation technology. The report cites that nuclear generates carbon-free electricity with lifecycle emissions of just 5-6 grams of CO2 per kWh, significantly lower than fossil fuels and even most renewables when accounting for their manufacturing and land use requirements. This makes nuclear power an essential part of any strategy to reduce greenhouse gas emissions and combat climate change.

Land use and transmission advantages

Nuclear power has the lowest land-use requirements of any energy source, producing more electricity per acre than solar, wind, and even hydropower. For regions with high land costs or limited available space, nuclear offers a compact solution that can be sited near demand centers, reducing the need for long-distance transmission infrastructure. This reduces the cost of transmission and also the environmental and social impacts of building new transmission lines.

Figure 3: Nuclear produces the most electricity per acre of any energy source

Source: DOE

Equity and environmental justice

The DOE report emphasizes that nuclear energy can play a key role in advancing environmental justice by creating high-quality jobs in underserved communities. Many nuclear plants are located in regions that have historically depended on coal or other fossil fuels for economic activity. By repurposing these sites for new nuclear projects, the U.S. can ensure that local communities retain access to well-paid jobs and economic stability.

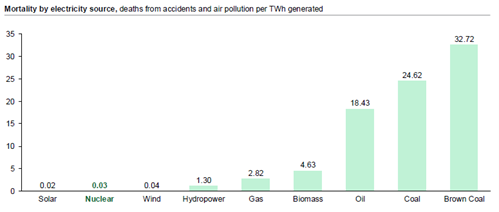

Nuclear power also reduces air pollution, leading to significant health benefits for communities located near power plants. Replacing coal and natural gas plants with nuclear energy can reduce emissions of harmful pollutants such as sulfur dioxide (SO2) and nitrogen oxides (NOx), improving air quality and public health. The US commercial nuclear safety record may surprise some in that it is ~5-times safer than working in electric power generation broadly and ~10-times safer than the average for all industries.

Figure 4: Nuclear is one of the safest sources of energy, in line with solar and wind

Source: Markandya & Wilkinson (2007); Sovacool et al. (2016); UNSCEAR (2008; & 2018)

Conclusion

The Pathways to Commercial Liftoff: Advanced Nuclear report outlines a comprehensive strategy for scaling up nuclear energy to meet the U.S.’s decarbonisation goals by 2050. Nuclear power provides a unique combination of clean, reliable energy that complements renewable sources and helps reduce the overall cost of the energy transition. However, achieving the goal of tripling nuclear capacity will require overcoming significant challenges, including workforce development, supply chain expansion, and financing risks.

The DOE report sharply contrasts with the Australian Government’s stance on nuclear energy, which it views as a costly option with minimal advantages for the decarbonisation transition. Meanwhile, the opposition party is campaigning on a platform that positions nuclear as a potential key element in achieving decarbonisation goals. There remains strong debate within Australia on the efficacy of nuclear power – particularly around costs. It also seems short-sighted that Australia is looking to introduce nuclear submarines yet is unable to rationalise the benefits of nuclear power, a source that most Western World countries have as a key component of their power needs.

The enormous power requirements for AI and data centres have only one low carbon solution and that is nuclear. California and Singapore for example have put a stop to new data centres given the enormous power requirements. We are seeing hyperscalers such as Amazon signing 20-year nuclear power supply contract, and Microsoft reopening closed nuclear power plants (3 Mile Island, Pennsylvania) as they source low carbon power solutions. Google has also just announced they have ordered 6-7 small nuclear reactors that will produce 500MW from California’s Kairos Power. The first reactor is due by 2030 and the remainder by 2035.

Investing in nuclear/uranium and uranium in Australia is quite limited, with BHP being the largest uranium producer as a byproduct of the giant Olympic Dam copper project in South Australia. The total market cap of uranium stocks in the ASX300 is a dismal $6b that includes Paladin, Deep Yellow and Boss. Silex Systems (SLX) has a unique laser enrichment technology that is in advanced stages of commercialisation and is backed by the DOE. The technology is third generation and offers much higher enrichment process efficiency (and thus lower costs). Tyndall is overweight BHP and is closely watching the development of the global nuclear industry in respect to the monumental energy transition task.