Our most recent trip to Perth saw us meet with producers, developers and industry aspirants across a range of commodity exposures from the traditional such as iron ore, which generates massive cashflows for companies, shareholders, and the state, as well as “future facing” metals like rare earths and lithium, which is facing falling prices and increased attention from larger companies. We share our key observations here.

Cost inflation: OpEx stabilises, capEx may rise

For the past two years (i.e. since the onset of the COVID pandemic), the mining sector has been experiencing industry-wide cost inflation primarily due to high energy prices, supply chain constraints, and labour shortages that have affected all industries across Australia. Unit costs for larger miners increased by approximately 40% between 2018 and 2022, and this trend is evident throughout the sector.

During our recent meetings with the miners, there was some discussion about the possibility of broad cost pressures starting to ease. While the cost of energy has recently declined due to lower oil prices compared to the previous year, the recent OPEC+ surprise cuts may put upward pressure on oil prices again, which could benefit our overweight energy position. Additionally, anecdotal evidence suggests that supply chain backlogs are beginning to clear.

The main concern now relates to labour, which can represent more than 50% of a miner’s total operating expenses. As state borders were closed due to COVID, the larger miners were in a better position to retain their workforce. To mitigate labour shortages, these miners offered incentives to retain interstate workers and expedited the hiring process to fill anticipated vacancies for upcoming growth projects. Meanwhile, smaller miners and contractors experienced a sharp decline in labour availability.

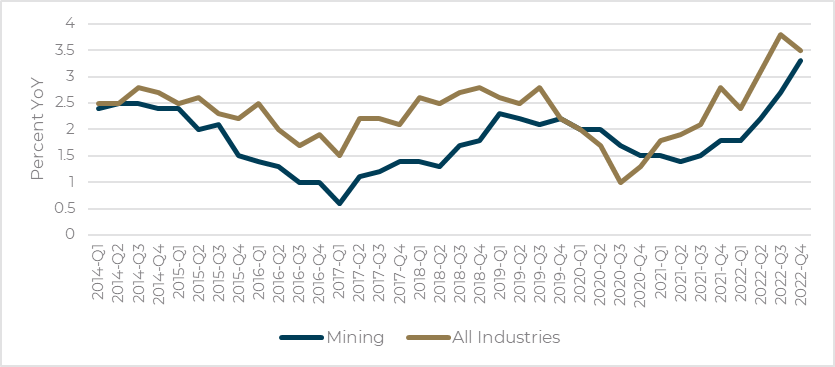

The larger miners are taking the lead in combatting labour cost inflation, as major iron ore projects conclude (e.g. South Flank and Gudai-Darri) and businesses seek to rationalise inflated post-COVID headcounts. It is early days, as evidenced by the ABS mining labour cost data which is yet to confirm a reversal. Nevertheless, across all Australian industries, a turning point is evident in recent data (refer Figure 1).

Figure 1: ABS Wage Price Indices – Mining vs. All Industries

Source: ABS, Tyndall Asset Management

If the labour force outside of mining is easing and skilled immigration is returning, these factors combined with what we have identified in recent meetings could mean cost inflation has now peaked. For the smaller end of town, though, it may lag the larger miners by more than six months.

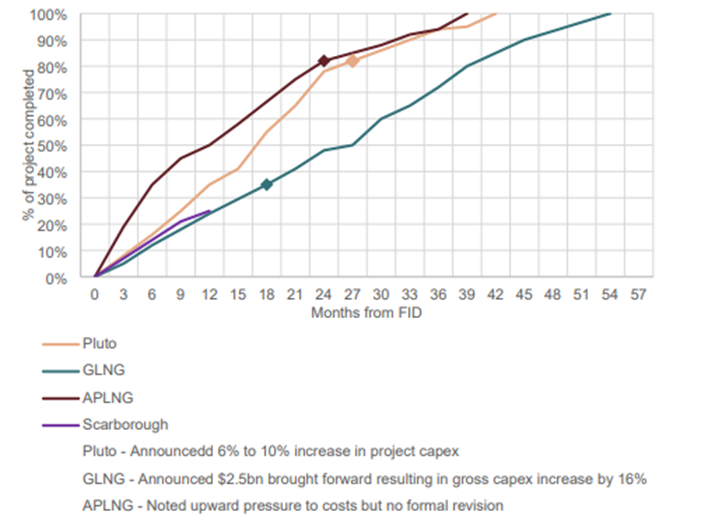

Importantly, capital projects may still be subject to inflation, particularly those currently moving from the pre-feasibility to definitive feasibility stage, and those under construction and less than 50-60% complete. The reason for this is the certainty around the expected final cost versus the initial budget is unclear until a project nears completion (refer Figure 2 which focuses on LNG project capex).

Figure 2: LNG project % completed when capEx increase announced

Source: Barrenjoey

We see evidence of the cost inflationary impact in projects such as Liontown’s Kathleen Valley lithium project, which in mid-2022 saw a circa 70% increase from the 2020 definitive feasibility study due to a combination of scope increase, material sourcing, and ensuring project delivery timelines were achieved (by paying for labour and materials in a competitive market). Fortescue’s Iron Bridge project has also been subject to two capex increases since construction commenced.

A few projects with potential for capex concern are held by companies in the Tyndall Australian Share Wholesale Fund, including IGO Group’s lithium CGP4 expansion and Iluka’s Eneabba Phase 3 Rare Earth Refinery. We account for potential for capex increases within our conservative estimates given the inflationary environment but see a positive outlook for both the operations in terms of margin for IGO Group and the commodity price for Iluka’s rare earths.

Global governments’ growing concerns on critical mineral supply

Commodity producers are excited about recent critical minerals supply chain policies enacted by governments worldwide. The US Inflation Reduction Act (IRA) offers incentives to consumers to buy products (e.g. electric vehicles) made with domestically sourced critical components or from Free Trade Agreed countries such as Australia.

The IRA also provides opportunities for direct government funding of new domestic project development through the Department of Defense and Department of Energy. Some miners are considering building downstream processing in the US for Australian-mined materials to take advantage of this funding source, while others are exploring the potential for accessing US funding for Australian-built projects intended for US consumption. It remains to be seen whether US laws allow for this, but given the USA’s need to secure critical materials and the drive to mitigate geopolitical risk, we would not be surprised to see Australian projects built with US funding.

The European Union’s recently released Critical Raw Material Act was discussed during our meetings, but the view at this time was that it remains largely speculative. This Act aims to simplify and unify mining regulations and policies across member states to facilitate the delivery of new projects, which may benefit miners such as Sandfire Resources, which has a large presence in Spain, as well as smaller lithium players. The potential benefit to Rio Tinto’s Jadar lithium project remains uncertain due to Serbia’s unresolved accession to the EU.

Lithium industry shake-up: Large miners capitalise on small miners struggles

Governments around the world are focussing on securing critical mineral supplies to meet ambitious decarbonisation objectives, a topic we have previously discussed. Our conversations with larger miners and trading houses indicate a growing interest in securing positions in the future commodity space, particularly lithium. Rio Tinto has expressed its intentions to expand into this area, while Glencore, Trafigura, and Mitsui have all been actively involved since late 2022 (which we expect will continue in 2023). The recent decline in both lithium prices and producer and developer share prices could present an appealing opportunity to enter this sector.

The entry of these giants can be a significant source of capital and offtake to underpin new investment. The recent takeover approach by Albermarle to Liontown illustrates how larger players are attempting to take advantage of a market lull, with the US lithium major pouncing on a company whose share price has suffered from capex overruns and funding shortfalls, combined with a weakening commodity price. We expect the consolidation theme may continue given the potential large-scale resources held by smaller cap ASX-listed companies, particularly in new regions like Canada’s Quebec. Our team within the recently launched Tyndall Australian Small Companies Fund will be analysing opportunities within this thematic.

Wrapping it up: Cost inflation plateau sought, lithium value emerging, critical mineral security in focus

Our visit to Perth and discussions with miners have given us some potential investment opportunities to capitalise on. A market too pessimistic about cost inflation may see stocks surprise to the upside once a possible plateau in the escalation is revealed in upcoming reporting seasons. And the market’s caution on the lithium space after the stellar run over the last two years has brought some high-quality companies back into our value universe. This is creating opportunities to grow our investments in the decarbonisation thematic. Finally, growing acknowledgment of the importance of critical mineral security globally has justified our views and investments in stocks such as Iluka where we are seeing the value created through the delivery of its rare earth business.