Whenever stranded assets are mentioned we are likely to conjure the image of a dilapidated oil terminal that no longer has any value attached to it due to alternate fuels or costly environmental regulations. Commercial real estate rarely enters our consciousness and as a result the REIT sector has never had the intense ESG spotlight shone on it by the public or the wider investor base.

How is ESG impacting investing?

ESG focused investing has really ramped up in recent history and has gradually shifted from just the direct operations of a company to now analyzing the impact of all its organs. As a result, firms will have to reflect and act on every part of their operations – whether that includes a manufacturer assessing the carbon intensity of its HQ, a pharmaceutical trying to lessen water usage at its distribution centre or a tech company maximizing the air quality on its campuses. Thus, the real estate occupied by those firms will become increasingly scrutinized and assets that cannot be adapted to the tenant’s growing requirements risk becoming obsolete and costly for its owners to hold.

While there are many prisms to look at commercial property from an environmental perspective, the NABERS (National Australian Built Environment Rating System) Energy rating guide is arguably the most comprehensive in its coverage, especially for Australian office assets. Buildings are given a rating on their energy efficiency using a 1 – 6 star system on a relative basis compared to their peers.

While there are similar NABERS ratings on water, indoor air and waste, energy has grown to be the most prolific due to legislative requirements. Under the current system all commercial offices over 1000sqm that wish to advertise for leasing or selling purposes must disclose their NABERS energy rating. Furthermore, in order to attract the government as a tenant the base building requires a minimum 4.5 star NABERS rating. As a result, NABERS has become the leading benchmark for assessing the ‘green-ness’ of a property.

What can businesses expect to see?

The current landscape in the Australian market is that of institutional investors leading the pack and commandeering more of the higher star rating assets. Morgan Stanley research found that the three biggest listed office landlords had a significantly high performing portfolio with Mirvac (MGR), Dexus (DXS), and GPT achieving a portfolio average rating of 5.5, 5, and 5 respectively for their office assets. This has largely been the result of an active development pipeline helping refresh the age of the portfolio as well as conscious decisions to refurbish older assets to meet modern environmental standards.

Employees are also increasingly expecting their employers to be environmentally conscious – a survey by HR resource company ELMO found that 71% of Generation Z workers would refuse to work for a company that was not seriously dealing with climate change. Furthermore, ambience and aesthetics are also rising in importance with a future workplace wellness study found that 31% of employees lose the equivalent of 60 minutes of productivity if the environmental wellness of their environment such as air quality and other factors were not satisfactory. Increasingly the mental health of employees is being brought to the fore thanks to the pandemic and companies who wish to be seen as socially responsible will need to accommodate this. Employers are taking note – JLL reported that 73% of their APAC based tenants surveyed saying they will be retrofitting assets by 2025 to meet these requirements such as achieving net zero and ensuring the office is a pleasant location to be.

The COVID pandemic has shaken up the office sector in various ways. Vacancies in CBDs have ballooned, with Sydney climbing from 4% pre-pandemic to 13% currently. Companies are re-assessing their space requirements which will certainly be influenced on how successfully they are able to persuade staff to return to the office. With widespread reports of labour shortages, it looks that the balance of power has shifted towards the employees. Employers in a post-COVID world will face the dual challenges of keeping their staff by aligning their actions with the staff’s ESG values as well as also providing enticements to lure them back into the offices – no doubt challenges landlords will have a stake in.

It has become clear that for employers to retain talent and encourage employees back to their offices for physical collaboration, they will need to ensure their assets and workspaces are up to scratch. Feedback from asset owners and leasing agents are that expectations from tenants are shifting to asset owners providing the amenities required by their employees such as coffee shops or breakout areas whereas previously the landlord was only responsible for the capital to ensure the base building was environmentally friendly. The costs of these amenities historically would be recouped through higher rents or lower incentives however the supply/demand dynamics in this market means tenants have effectively externalized a portion of their costs to meet environmental and social expectations to landlords.

Where are we seeing vacancies?

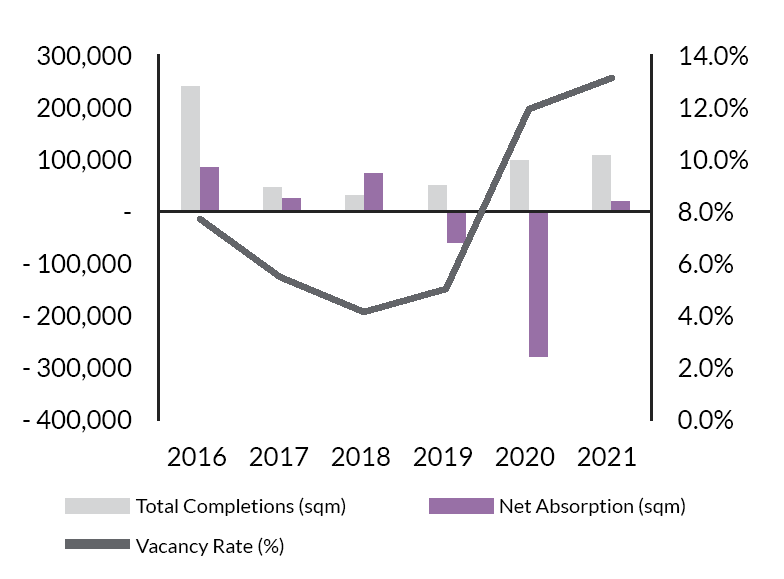

If history is any guide, the current over-supply situation (highlighted by elevated vacancies) will result in lower rental price growth and higher incentives (in the form of fit out contributions or rent-free periods) which negatively impact the cashflow of the landlords. While this trend was observed in 2020-2021, our channel checks have found that the performance of assets have become increasingly bifurcated. Prime grade assets (Premium & A grade) continue to hold onto higher rents and lower vacancy while the declines in rents has mostly been felt in B grade assets and below. One asset owner has even stated that they are seeing further bifurcation with A grade starting to lose some of its lustre leading to a ‘Premium vs everything else’ situation. This trend has been accelerated post-COVID with a common theme in the Feb-2022 reporting season being an acute sense of ‘flight to quality’. For example Mirvac called out 80% of their vacancies were located in their lower tier assets.

This is not surprising given higher-grade assets predominately have 5-6 star ratings further enhanced with numerous amenities to maintain tenants and their increasingly demanding staff. The Australian listed market and other large institutional owners have been acutely aware of this and have largely been successful in ensuring their portfolios are at the higher end of the NABERS spectrum. Conversely, B-grade assets and below are mostly held by private owners. Typically such owners have less access to capital and as such may struggle to make the necessary investment to upgrade the asset ratings. Refurbishments required to drive an increase in the NABERS ratings require significant capital and often involve asset downtime (from 1 – 2 years). Activities such as replacing the cladding of a building has shown to potentially cost >10% of the asset value itself. As such, we expect more and more assets becoming more obsolete as the capital costs to upgrade older assets are prohibitive especially for non-institutional investors.

Additionally, debt markets are also starting to differentially price ESG factors. In 2021 GPT issued their inaugural Green Bond of $250m and we expect this to be the first of many. Whilst this has not translated to lower cost of debt for green assets yet, expectations are that liquidity pools will become more discerning around ESG which over time should translate to higher cost of debt for ESG-poor assets.

Ultimately while we are concerned about the current oversupply in the market and the uncertainty in the sector’s vacancy outlook due to COVID and increased working from home, we are somewhat comforted by the fact that the Australian listed players have positioned themselves relatively well in regards to the sustainability of their asset portfolios. This should partially offset future structural uncertainties as we believe not all the competing supply in the market is fit for purpose and given ESG requirements on buildings are only getting more stringent, we expect the pool of ‘ESG-ready’ assets to shrink further.